MoneySwell Search Results

Three Critical End-of-Year Reminders

Beyond the Rush: Why Year-End Financial Focus is Non-Negotiable The final months of the year are busy! But with end-of-year financial deadlines that can impact your financial health, a well established money management routine [...]

Open Enrollment Season

Around this time of year, you might be wondering, “When is open enrollment?” As it turns out fall is the only time most people can change or sign up for health insurance (otherwise known [...]

From $850 to Roth IRA: My Early Personal Finance Journey

About 20 years ago, I graduated from college, moved to New York City, and spent my savings on rent, security deposit, and a broker’s fee for my first apartment. I had less money in [...]

The Micro Math on Micro-investing

Micro Investing allows you to invest small amounts of money consistently over time. The amount invested is often the rounded-up difference between a given transaction and the next whole dollar. For example, a [...]

How to Estimate Your Retirement Nest Egg Needs

A “Nest Egg” is your accumulated savings and investments that you use during your retirement to support your lifestyle. Estimating nest egg needs is an imperfect science and will change over time. But [...]

How to Project Your Future Outlook for Retirement Planning

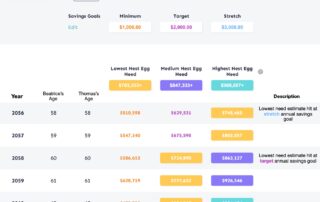

The Future Outlook table helps you understand if your current level of savings puts you on track to meet your retirement goals. The Future Outlook table shades in values that meet your low, [...]

How to Estimate Your Annual Investment Growth Rate

Determining the annual growth rate of your investment portfolio is done using the Money-Weighted Rate of Return (MWRR) formula. The MoneySwell Retirement Planner estimates your annualized rate of return using the MWRR formula, [...]

How to Achieve an Earlier or More Affluent Retirement

If you want to retire before you originally planned, you want a more affluent retirement lifestyle, or you want to build a buffer against a lower-than expected rate of return, you can increase [...]

Retire by Your Goal Retirement Age

In a previous task, you calculated your retirement nest egg number for three different methodologies and wrote it down in the notes section. You may also have used the MoneySwell Retirement Planner to [...]

Increase Retirement Savings Rate to Extent You Can

Based on the items you already completed in the Growth tier, you should be ready and able to increase your savings rate from the percent you previously set. Use the MoneySwell Budget Planner [...]