Quick Look

- A “Nest Egg” is your accumulated savings and investments that you use during your retirement to support your lifestyle.

- Estimating nest egg needs is an imperfect science and will change over time. But rules of thumb are an effective way to guide you toward some reasonable numbers.

- MoneySwell’s Retirement Planner uses a broad-based approach to estimate your needs using a minimal number of inputs.

- Working with a Certified Financial Planner is a good way to get a more personalized estimate for your needs. But regularly using the MoneySwell Retirement planning tool can be a good way to keep you on track.

What is a ‘Nest Egg’ anyway?

Let’s start by defining a retirement ‘nest egg.’ A retirement nest egg is the money you have saved and invested during your working years. The most common types are 401ks and various types of IRAs because these types of accounts have certain tax benefits. However, any account with savings – or more likely, investments – can be considered a nest egg. When you retire and are no longer earning an income (or aren’t earning enough), you start to draw down your nest egg. Typically this will mean selling some of your investments and using the proceeds to fund your lifestyle.

How big does my nest egg need to be?

The central question when saving for retirement is, “How much will I need?” And here’s the surprising fact: No calculator or financial planner can definitively tell you. The reasons are threefold.

Firstly, nobody can precisely know how your investments will perform during retirement. When people retire, they don’t immediately sell all their investments and stuff the cash under their mattresses. Instead, the majority of their nest eggs will continue to remain invested. As with all investments, the value of those assets may grow or decline. The extent to which a portfolio grows or declines can have a significant impact on how long the portfolio will last.

Secondly, inflation can have a significant impact on a retirement nest egg. Inflation is a devaluation of your existing dollars. Put another way, if $100 buys you and your partner a nice meal today, a decade from now that same $100 may only be enough for drinks and appetizers. Since the rate of inflation varies, it can be hard to predict if a certain saved dollar amount will be enough to help you buy all the nice dinners you were planning for in your retirement years.

Finally, it can be hard to estimate your nest egg needs because your retirement lifestyle and associated costs are unknown. If you’re 60 and a few years from retirement, you may have a pretty good idea of what your expenses will be, at least for the first part of retirement. But when you’re 25, knowing how much your life will cost many years or decades from now is virtually impossible. There are simply too many unknowns.

Fortunately, there are several good rules of thumb for estimating nest egg needs. These rules of thumb are based on long-term historical trends and data from millions of retirees. When used appropriately, these guidelines can be incredibly helpful in your planning process. And that’s where MoneySwell comes in.

MoneySwell Can Estimate Your Nest Egg Needs For You

With a few basic inputs the MoneySwell Retirement Planner is set up to answer, “What are your nest egg needs now?” Instead of trying to predict a future number based on income and expenses, MoneySwell asks you for information about your current income and expenses. Then, as your life changes from year to year, you can update those numbers and watch your estimated nest egg needs update too. Of course, you can always use projected income or expenses if you like. But when you use your current values, your estimates will be based on the value of today’s dollars and what you would be projected to need if you wanted to retire today.

How does MoneySwell do this? MoneySwell estimates your nest egg needs in three steps.

-

- Calculate the Rules of Thumb: Using your inputs, MoneySwell calculates your needs using three well-known rules of thumb. It then calculates a range within each rule of thumb to produce a “low”, “medium” and “high” estimate. The rules of thumb MoneySwell uses are the Income Multiplier method, the 4% Withdrawal method, and the Annual Expenses method. Here’s the short description of each method:

- Income Multiplier: Experts suggest your nest egg should be between 10 and 17x your annual, pre-retirement income.

- 4% Withdrawal: This method estimates a reasonable withdrawal rate from your portfolio to generate retirement income from your investments.

- Annual Expenses: When you have between 25 to 30x your annual expenses appropriately invested in a diversified portfolio, you may have enough to retire.

- Factor in Other Income: Your nest egg may not be your only source of income in retirement. Therefore, if you have other income sources (and your expenses remain the same), any additional income you have reduces the size your nest egg needs to be. MoneySwell factors this into your original rules of thumb calculations.

- Average the Results: With your final “rules of thumb” calculated after considering your other income sources, MoneySwell then averages each method’s low, medium, and high estimate with the other methods’ low, medium, and high estimates.

- Calculate the Rules of Thumb: Using your inputs, MoneySwell calculates your needs using three well-known rules of thumb. It then calculates a range within each rule of thumb to produce a “low”, “medium” and “high” estimate. The rules of thumb MoneySwell uses are the Income Multiplier method, the 4% Withdrawal method, and the Annual Expenses method. Here’s the short description of each method:

What do my final nest egg needs estimates mean?

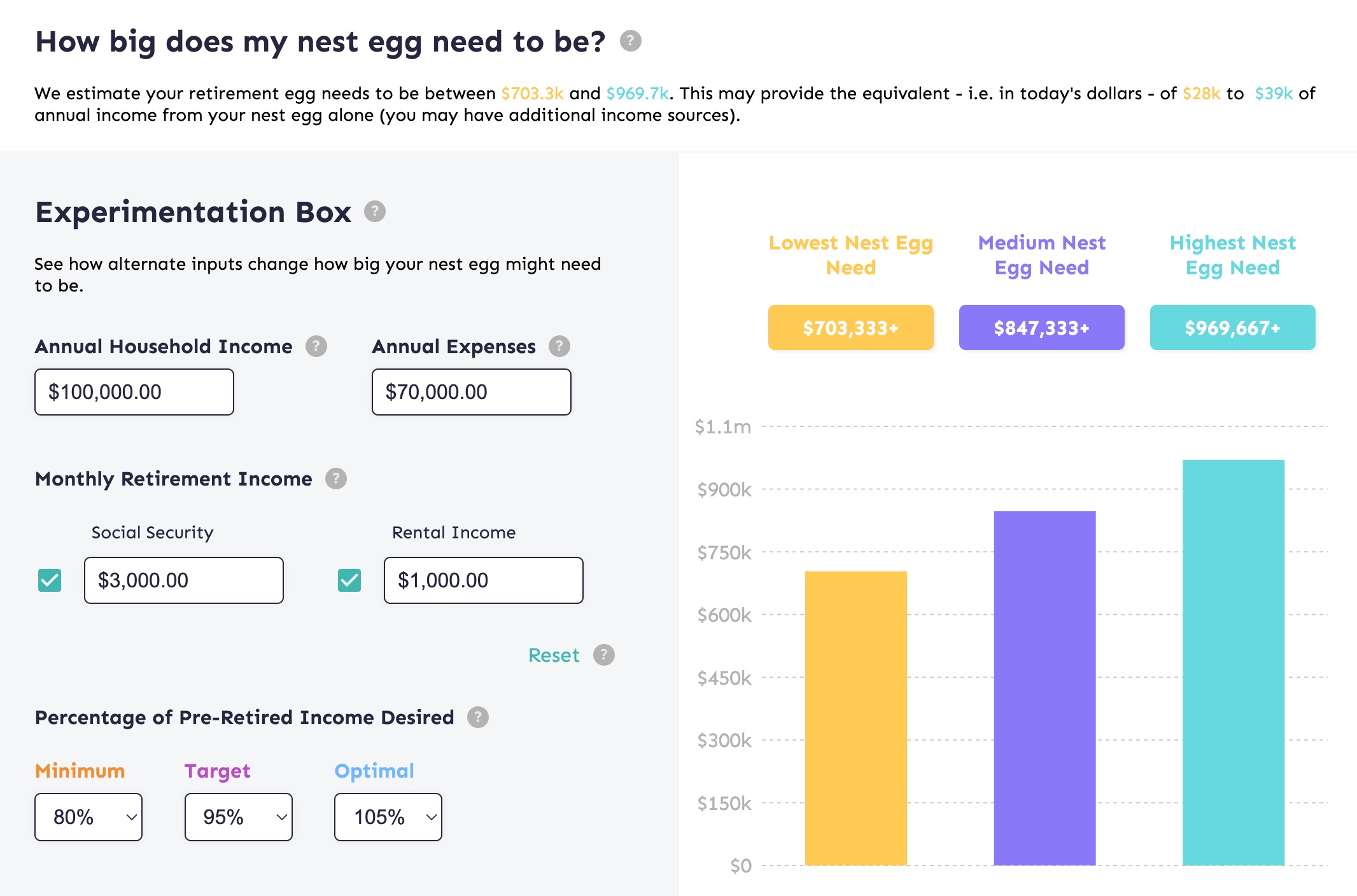

The MoneySwell Retirement Planner produces three nest egg needs estimates and a way to experiment with alternate scenarios to see your numbers change.

Your low, medium, and high estimates represent a range of how much you may need. However, there are a few important things to note.

First, if your inputs for income and expenses are based on your current income and current expenses, your estimate is in “today’s dollars.” But if you believe your income or expenses will rise in the future, we suggest using the Experimentation Box to test alternate inputs and see what a future projection of your nest egg needs might be.

Secondly, lifestyle, health, and other factors can significantly affect how big your nest egg needs to be. For example, if you anticipate a retirement filled with lots of international travel and other luxuries you will probably need something toward the higher end of your estimates. Similarly, if you anticipate high healthcare expenses, your higher estimate might be closer to the mark.

Finally, it’s important to note that when you retire has an impact on your nest egg needs. All else being equal, the earlier you retire, the longer your nest egg needs to last. Many of the “rules of thumb” the planner uses are based on the concept of a 30 year retirement. If you plan to retire significantly before that, you should lean toward your higher estimated needs.

If you’re concerned that your estimates might be too low for your circumstances, you can increase the “Percent of Pre-retirement Income Desired” values. Experts typically say that retirees will need between 70 and 90% of their final pre-retirement income. However, by increasing your percentages, this effectively raises your income. The end result is estimates that are higher than they otherwise would be.

Going Beyond Your “Estimate”

Don’t forget that these are only estimates based on a few inputs and rules of thumb. If you are looking for something that is more specific to your individual circumstances, or if you have questions about how your investment portfolio should be balanced, you may want to work with a Certified Financial Planner (CFP). But remember: Even a CFP’s estimate will change with time. The MoneySwell Retirement Planner works best when you use it over time and update your numbers regularly.

If or when you do decide to work with a CFP for a more personalized estimate, the savings targets and Nest Egg Needs estimates from this planner will likely have put you in a much better position than you otherwise would have been.

Related Videos