MoneySwell Archive

Search for pages and posts across the site.

Why MoneySwell is Sitting Out Black Friday

In a previous life, I worked with some of the most well-known brands in the world. My job? Help these brands sell more stuff. Specifically, my focus was on digital marketing—using a variety of [...]

End-of-Year Budgeting Tips & Tricks

The final months of the year can feel like a tsunami of spending. Between back-to-school costs, holidays, travel, and social events, it's easy to feel stressed and lose control of your budget. (In our [...]

Money Management For the 95% (and the other 5%)

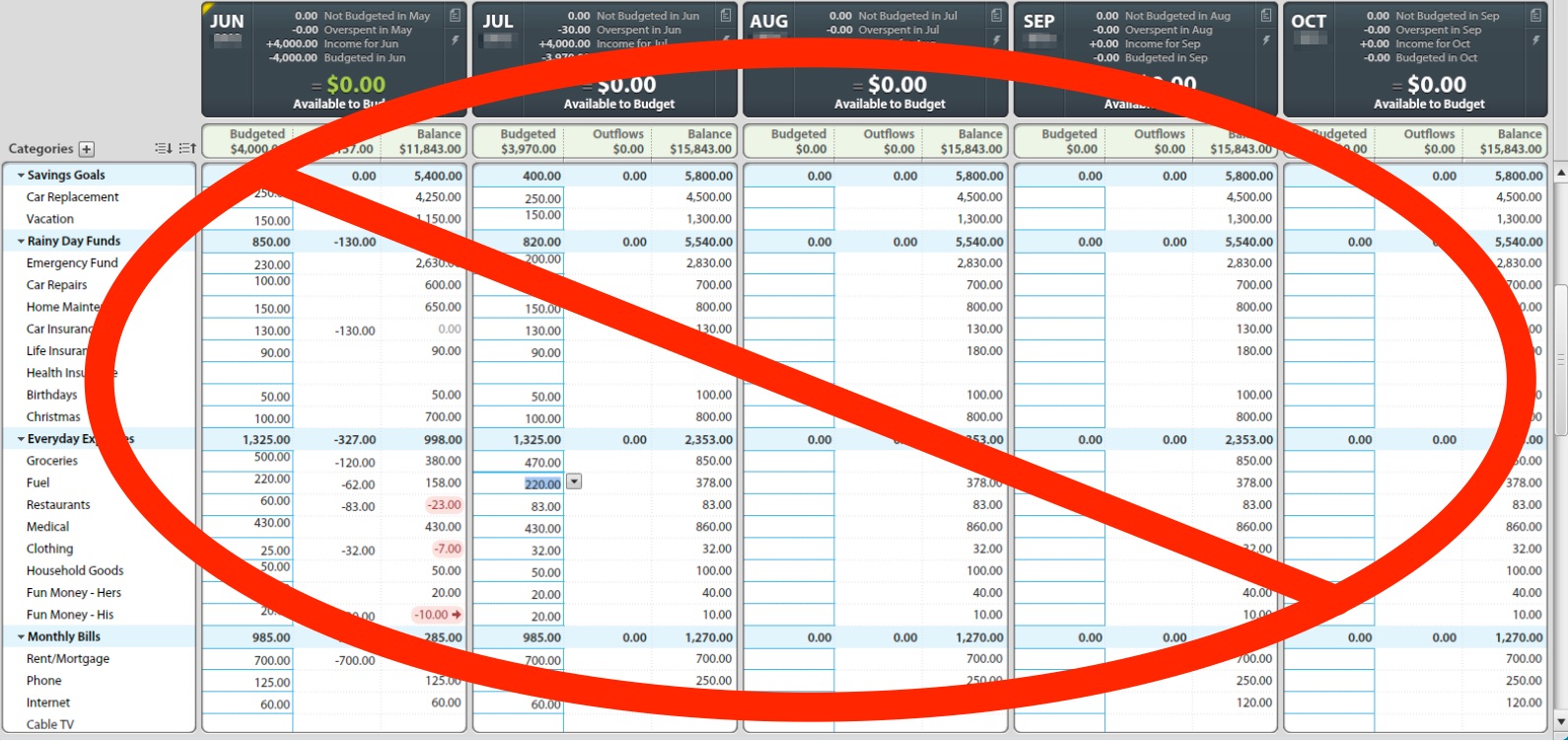

How to Get Your Financial Life On Track For a decade, I was in the 5%—the rare financial enthusiast who tracked every single dollar in a detail-oriented personal finance tool. My rows and [...]

Three Critical End-of-Year Reminders

Beyond the Rush: Why Year-End Financial Focus is Non-Negotiable The final months of the year are busy! But with end-of-year financial deadlines that can impact your financial health, a well established money management routine [...]

Open Enrollment Season

Around this time of year, you might be wondering, “When is open enrollment?” As it turns out fall is the only time most people can change or sign up for health insurance (otherwise known [...]

From $850 to Roth IRA: My Early Personal Finance Journey

About 20 years ago, I graduated from college, moved to New York City, and spent my savings on rent, security deposit, and a broker’s fee for my first apartment. I had less money in [...]

The Four Big Blockers To Financial Fitness

For most people, most personal finance tools don’t work. When talking to real people about their experiences with other tools, we consistently heard, “I tried it, but couldn’t stick with it.” Not “sticking with [...]

How to Achieve Your Financial Goals this Year

Many employers top up your “wellness dollars” at the beginning of the year and typically you can use those for personal finance applications like MoneySwell! If you want to learn how to build [...]

MoneySwell in Less than 90 Seconds

In less than 90 seconds (79 seconds to be exact) get a nice overview of MoneySwell. Enjoy!

The Employer-provided Benefit Your Employees Want

An employer provided financial wellness benefit helps employee productivity An employer provided financial wellness benefit helps reduce employee turnover An employer provided financial wellness benefit makes employees feel welcomed (when they're new) and [...]

Do you really want to give every dollar a job?

Budgeting is powerful and important, but the traditional methods don’t work for most people. I’m a personal finance geek and I’ve never really budgeted. MoneySwell is building a new version of Budget Planner [...]

I read a personal finance book. Then forgot 90%.

Personal finance books can be great, but they fail to solve key challenges. They’re not in tune to our current circumstances and they don’t provide the continuous interaction that can encourage follow-through. Even [...]

The Micro Math on Micro-investing

Micro Investing allows you to invest small amounts of money consistently over time. The amount invested is often the rounded-up difference between a given transaction and the next whole dollar. For example, a [...]

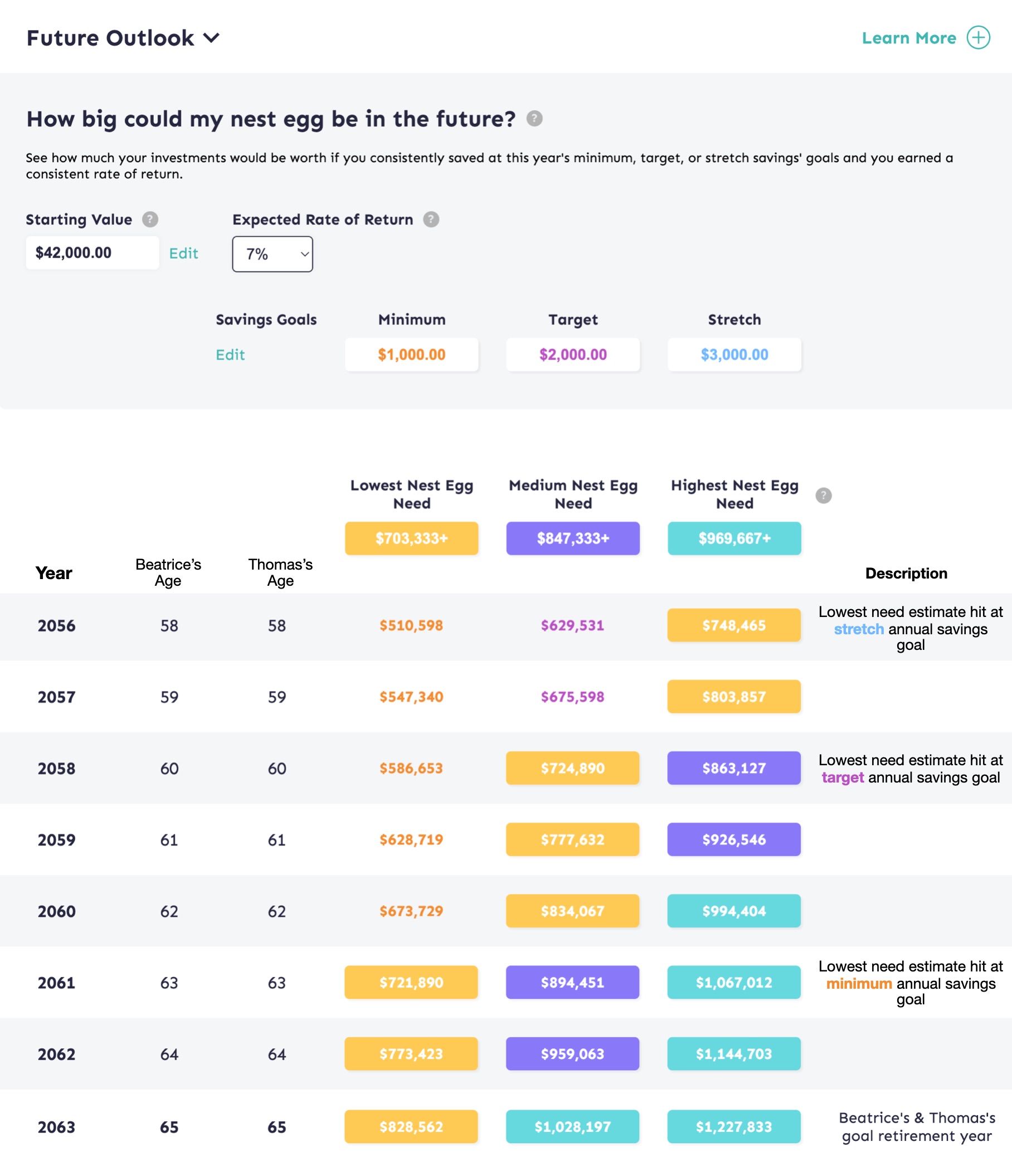

How to Project Your Future Outlook for Retirement Planning

The Future Outlook table helps you understand if your current level of savings puts you on track to meet your retirement goals. The Future Outlook table shades in values that meet your low, [...]

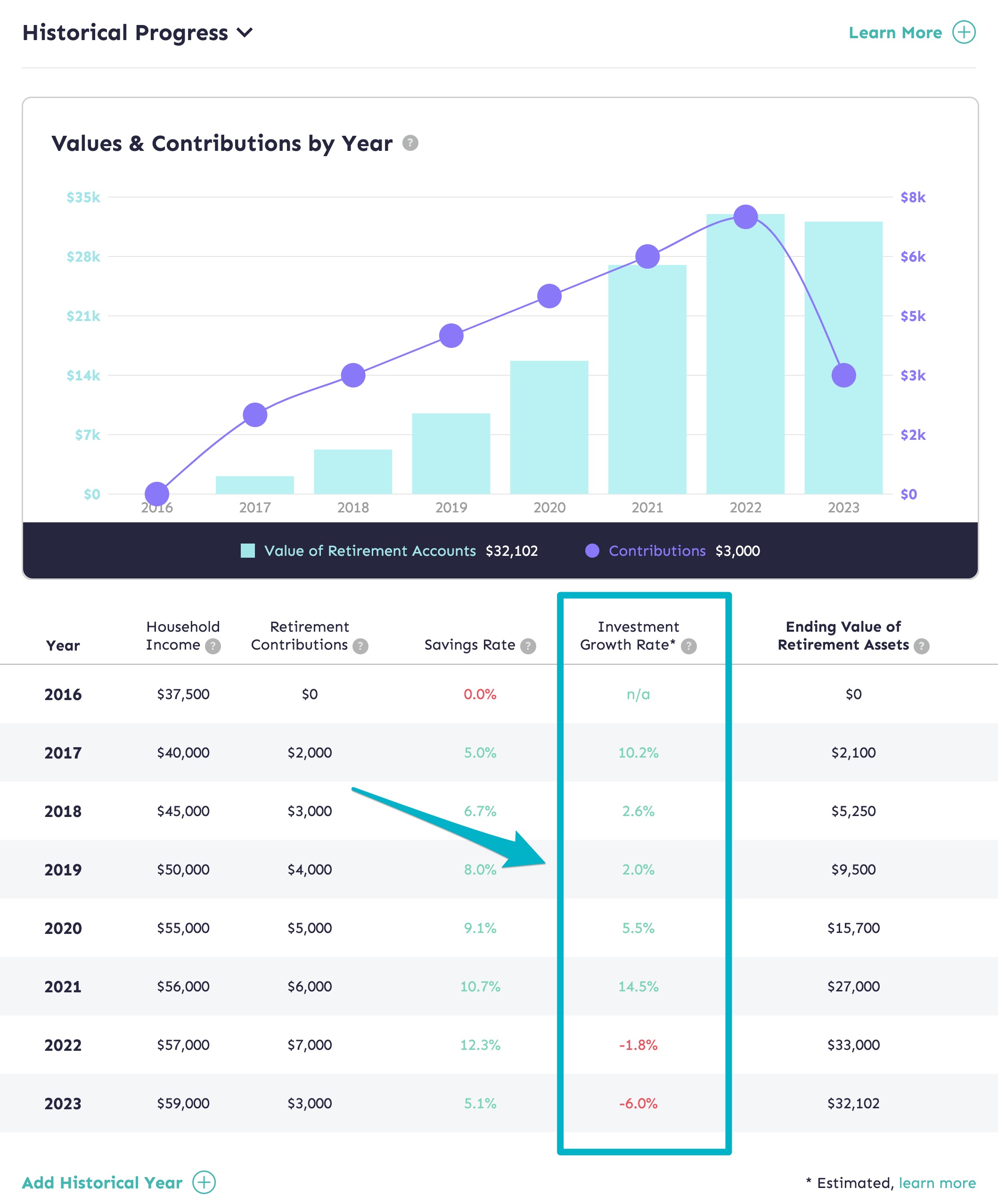

How to Estimate Your Annual Investment Growth Rate

Determining the annual growth rate of your investment portfolio is done using the Money-Weighted Rate of Return (MWRR) formula. The MoneySwell Retirement Planner estimates your annualized rate of return using the MWRR formula, [...]

ARCHIVE TAGS

Find a topic related to your interest area.