Quick Look

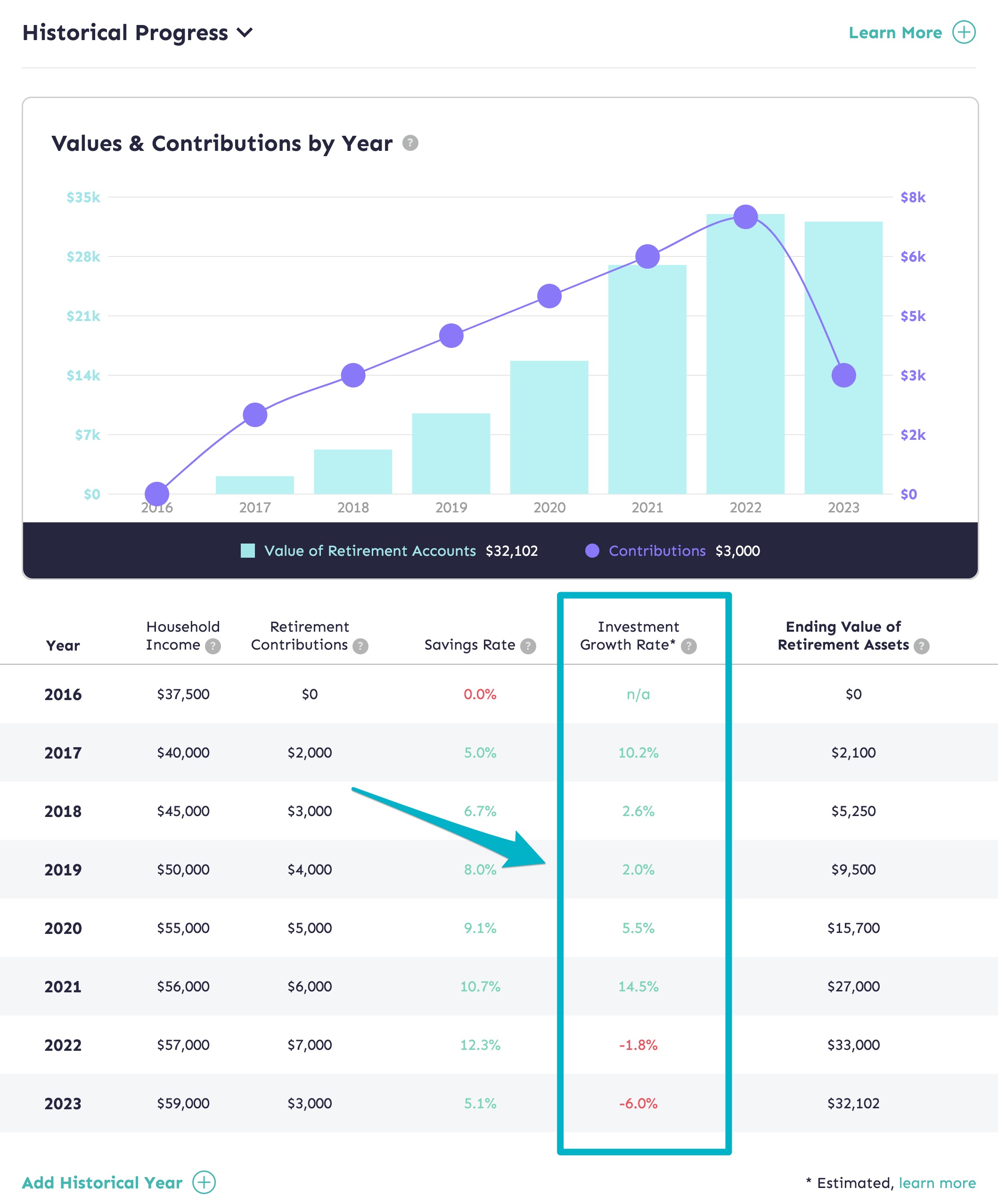

- Determining the annual growth rate of your investment portfolio is done using the Money-Weighted Rate of Return (MWRR) formula.

- The MoneySwell Retirement Planner estimates your annualized rate of return using the MWRR formula, but it makes a few assumptions which means it is only an approximation.

- MoneySwell’s estimated growth rate will be most accurate for those making regular contributions (e.g every other week, monthly, quarterly etc.) or for those who space lump sum contributions relatively evenly in the first half and second half of the year.

- You can compare the performance of your portfolio to a fund (e.g. a target date fund) or broad benchmark index (e.g. the S&P 500) to get a sense of your personal performance in a given year.

- Understanding your annualized rate of return over many years can help you understand how closely your estimated growth rate aligns with the actual growth rate of your portfolio.

Why a Special Formula?

Imagine the following scenario: On January 1st, your retirement portfolio was worth $20,000. Then, on December 31st, it was worth $25,000. Now ask yourself, “What was my portfolio’s investment growth rate?” At first glance, it seems like a simple calculation. It grew by $5k and since $5k is 25% of $20k, your portfolio grew by 25%…right? Not so fast.

As individuals trying to discover our portfolio’s investment growth rate, we’re typically asking, “How did my investments perform?” To answer this question with an annualized rate of return, we need a little more information. In addition to knowing the starting and ending value for the specified time period, we also need to know how much we contributed (or any withdrawals that were made), and when those contributions (or withdrawals) were made.

Continuing with our example, what if we told you that on December 31st, you made a $5,000 contribution and your ending value of the portfolio was still just $25,0000. In this case, your investment growth rate would be 0%. That’s because on January 1st you had $20k, and you still had $20k on December 31st. It was only when you made the $5k contribution that it jumped to $25,000. In other words, all the “growth” came from contributions you made, not from an inherent growth in the assets in the account at the beginning of the year.

This is where the Money-weighted Rate of Return (MWRR) formula comes in. Without getting into all the complex details (after all, Investopedia already does a great job of that), the MWRR takes into account contributions and deductions from a portfolio as well as when those contributions and deductions took place. From there, it calculates the true investment growth rate.

Why Only an “Estimate?”

You may ask, “If MoneySwell uses the MWRR formula, then why is the growth rate only “estimated’.” Remember when we said that the MWRR formula needs to know when contributions were made? Well, in order to make your life simple, MoneySwell doesn’t ask you to track every investment transaction. If we did, you’d have to enter the date you made every purchase and the amount it was for.

Instead, MoneySwell makes an assumption. We assume you make a lump sum contribution right in the middle of the year, on June 30th. This “assumed” contribution is for the total amount you contributed that year. If what you’re actually doing involves making regular contributions, about half your investments will happen before June 30th and half will happen afterward. The result is that the rate of return MoneySwell estimates will be quite accurate. The more you cluster investments near the beginning or end of the year, the less accurate your estimate will be. But as a guide, this is a simple way to get a rough estimate of investment performance.

Why An Estimate is Good Enough and How to Use It

Other than bragging rights, what good is knowing your investment performance? For the purposes of the MoneySwell retirement planner, there are two goals.

The MoneySwell Retirement planner can help you estimate your investment performance over many years.

Firstly, when calculating the possible value of your nest egg in the future, you must include an assumed rate of return. If the rate of return you assume is significantly higher or lower than what you are actually getting, you might want to make an adjustment to your assumed rate of return. Then, as you review your portfolio’s updated future projections, you may discover the need to contribute more or less to meet your goals.

Secondly, knowing your portfolios approximate annual rate of return allows for comparisons. Remember: the market is volatile. There may be years where your rate of return is up 15%. In other years it may be down 15%. But for you to know if those are “reasonable” returns, you need to compare it to another indicator. This could be a specific target date fund or a broad market index like the S&P 500. Think of it this way: Is a 1% return in a given year good or bad? Well, if that 1% return happened when the S&P 500 was down 20%, that return is fantastic! But if that 1% return happened when the S&P 500 was up 20%, you might consider adjusting your portfolio.

Secondly, knowing your portfolios approximate annual rate of return allows for comparisons. Remember: the market is volatile. There may be years where your rate of return is up 15%. In other years it may be down 15%. But for you to know if those are “reasonable” returns, you need to compare it to another indicator. This could be a specific target date fund or a broad market index like the S&P 500. Think of it this way: Is a 1% return in a given year good or bad? Well, if that 1% return happened when the S&P 500 was down 20%, that return is fantastic! But if that 1% return happened when the S&P 500 was up 20%, you might consider adjusting your portfolio.

Most of the Way There

If your goal is to perfectly calculate your personal investment performance, and you often make significantly more contributions at the beginning or end of year, MoneySwell’s estimate may not be right for you. (And, you may want to work with a Certified Financial Planner or Registered Investment Advisor. They will have explicit legal requirements for calculating your personal rate of return).

On the other hand, if you are looking for information to guide you, MoneySwell’s Retirement Planner should be very helpful.

Investment Growth Rate and MWRR FAQs

- Is the MWRR (Investment Growth Rate) adjusted for inflation? The short answer is no. A money-weighted rate of return simply looks at the performance of an investment portfolio given contributions and withdrawals. But it does not consider the value of those dollars over time. That being said, a single year’s return will only be impacted by the inflation rate of that single year. Conversely, a return over several years needs to consider the inflation over that entire timeframe.

- My investment growth rate is often higher than 10% in a given year. But in the Future Outlook Table (Step 2), MoneySwell only allows me to set an Expected Rate of Return at 10% and no higher. Why? The Expected Rate of Return in Step 2 is meant to be an inflation-adjusted rate of return. But your individual year returns in your Historical Progress table are not inflation-adjusted. This means those numbers will typically be higher than the inflation-adjusted or “real rate of return” you got in any one year (or could expect to get over many years). Because MoneySwell calculates your nest egg needs in today’s dollars, it is necessary to project future growth based on what the real value of those dollars would be in the future. This means the growth rate must be inflation-adjusted. According to Investopedia, the inflation-adjusted average annual rate of return for the S&P 500 Index is around 8.5%.

- (Note: Depending on your source, even this estimate will vary. Typically the variation has to do with how far back different estimates are starting from. For various reasons, some calculators will estimate historical returns going back to the 1800’s, whereas others will choose one of a few key dates in the 1900’s when significant changes to the index were made.)

- Letting users assume a rate of return higher than 10% would likely result in unrealistically positive projections on the future value of a portfolio. Therefore, MoneySwell has limited the high end of that value. See our article here for guidance on what to use for your estimated rate of return.

- How is my investment growth rate calculated for the current year? For completed years, MoneySwell assumes you made a lump sum contribution on June 30th. (This is effectively the same as if you made regular contributions for the same amount over the course of the entire year). But in the current year, MoneySwell finds the “midpoint so far.” This date represents the “June 30th equivalent” for full years. For example, if the date is January 30th, MoneySwell assumes you made a lump sum contribution on January 15th, halfway between January 1st and January 30th. Additionally, the MWRR formula is produces an annualized return rate. Effectively, this means it’s intended for time periods of 1 year or more. Therefore, for the current year (which is less than a full year) MoneySwell makes some adjustments. These adjustments “de-annualize” it. This ensures your rate of return is always accurate (while still recognizing the assumptions stated above).

Related Videos