Quick Look

- Budgeting is powerful and important, but the traditional methods don’t work for most people.

- I’m a personal finance geek and I’ve never really budgeted.

- MoneySwell is building a new version of Budget Planner that helps you track what matters in about ten minutes a month.

Contents

Let Me Be Honest

First, this post is about the “B” word, budgeting. Second, I’ve never really been a budgeter. Third, at MoneySwell, we’re building a new Budget Planner tool. And fourth and finally, we’re hoping that after reading this post, you’re intrigued by MoneySwell’s concept of budgeting and give MoneySwell a try.

The “B” Word

About a third of 18-24 year olds have a budgeting app installed on their phones. But most rarely use them.

About a third of 18-24 year olds have a budgeting app installed on their phones. A THIRD! When you think about how boring budgeting is, that’s astounding, particularly for this demographic. This tells us two things. First, there’s a strong desire for people to get control over their finances. Second, as boring as budgeting is, it’s still a powerful tool.

But here’s the problem: Most people don’t stick with budgeting. In fact, most apps are opened fewer than two times. Anecdotally, we talked to tons of people when developing MoneySwell and nearly every one of them could name a budgeting app they had tried. But only a few still used their app consistently today.

Clearly, there’s room for improvement. Because when it comes to financial wellness, two things that matter are consistency and duration.

I’ve Never Really Budgeted

On the one hand, it’s pretty embarrassing for a founder of a personal finance app to admit he’s never really budgeted. On the other hand, it proves the point that traditional budgeting sucks. If a self-proclaimed personal finance geek can’t stick with it, what hope do the non-geeks have?

One popular budgeting tool uses the slogan, “Give Every Dollar a Job.” I’ve never been a power user of this tool myself (see above statement) but I know people who have followed this system and found it life changing. To those people I say, “Bravo!” and “Keep going!” But for most, giving every dollar a job isn’t sustainable or even necessary.

I’ll admit that there was a period of my life (about a decade) where I tracked every dollar I spent. But I didn’t budget. Instead, I just spent less than I earned and saved a reasonable amount. To be clear, I understand that this is easier said than done and much easier for some than others based on personal circumstances.

This worked well for a long time. But as my life got more complicated (mortgage, marriage, and mini humans) I realized I wanted more control over my finances. But I still didn’t want to track every dollar.

A New Way to Budget – The MoneySwell Budget Planner

As I mentioned, Budget Planner – which is just one of MoneySwell’s tools – is under development. But our basic version that’s available now, focuses on three key concepts that can make budgeting sustainable, and impactful.

-

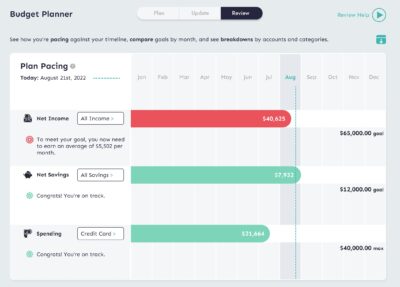

- Keep It Simple: We asked ourselves, “What’s budgeting all about anyway?” It turns out, the answer is remarkably simple. It’s about income, saving, and spending. All the work you do in a budgeting tool should focus your attention on achieving your income, saving, and spending goals. The rest is just details.

- Track Spending that Matters: Most budgeting tools essentially say, “Here’s all the money you spent (or plan to spend)! Assign categories to all this spending!” But that doesn’t work for most people. So we flipped it on its head. Just track the categories that matter to you and assign dollars to those. Lump everything else into a generic spending bucket.

- Track by Month, Set Goals by Year: Have you ever given up on budgeting after blowing a budget category? Typically, the problem is that the focus is too short and the categories are too detailed. MoneySwell Budget Planner helps you set goals from a few months up to a year with as few categories as you want. When goals span multiple months, for categories that matter, you’re much more likely to achieve them.

What’s Next?

I’ve been using the basic version of Budget Planner for a few years. It works really well to help me track spending that matters and set goals for the year. But – and I told you I would be honest – it’s too manual. In that sense, it’s not as simple as it should be. This is primarily because our basic version doesn’t allow you to download your transactions. We’re building that and related functionality now.

I’ll know we’ve achieved our goal when I can track exactly what matters to me, see how I’m pacing for my income, saving, and spending, and when I can do it all very simply in less than ten minutes a month. (We’re nearly there!)

But more than that, I’ll know we’ve achieved our goal when people say that they’ve finally found a budgeting and money planning tool that works for them when nothing else did!

To check out our other tools, and to get a sense of what we’re building toward with Budget Planner, start a 34 day free trial today!