Quick Look

- The Financial Priorities Action Plan helps you build your personal finance literacy, take action, and get ahead.

- Your plan can be customized based on where you are in your financial journey by completing a brief survey.

- Reading this article is the very first step in your plan.

Overcoming Roadblocks to Financial Success

Have you ever found yourself thinking…

- I don’t have a financial plan or the personal finance literacy to create one.

- There’s a lot of information out there but I still don’t know if I’m doing the right things with my money.

- I’m not ready to work with a financial planner but I need to do something.

If so, you’re not alone. We’ve interviewed and surveyed hundreds of people and the statements above highlight the most common challenges people face as they try to improve their financial health.

But by completing the Financial Priorities survey and creating your customized financial action plan, you’ve forged ahead. You’ve demonstrated a commitment to improving your financial health. And now you have an organized plan to make the financial progress you want.

Understand The Plan

This plan is a tailored set of educational content and action steps. As you read the content and complete the tasks, your financial literacy will improve along with your financial health.

This plan isn’t a get rich quick scheme. In fact, similar content can be found from hundreds of reputable and widely read sources. However, MoneySwell has organized this content into a customized checklist just for you. Following through on your plan can amount to significant financial gain over the long-haul.

We won’t pretend that completing each step in your plan will be easy. Some tasks will be quick and others will take time. But by consistently moving in the right direction, you will soon find you are well on your way to financial health, and financial wealth.

Why This Plan Works

Your plan is based on the research of thousands of personal finance articles, dozens of personal finance books, seminars, webinars, online courses, countless hours of personal finance podcasts, and many conversations with Certified Financial Planners and Money Coaches. After all that, we can confidently say:

- The recommended approach to tackling basic financial priorities is nearly universal among financial experts.

- To make meaningful financial progress, you have to be patient, disciplined, and take it one step at a time.

- Many people miss out on opportunities to improve their financial health by failing to take some basic steps.

Your Financial Priorities Action Plan helps with all three. It follows the advice of the best in the business, helps you frame your financial goals for the long-term, and helps you take consistent, meaningful action.

Research has consistently shown that checklists are a simple and powerful tool to get us to take action.

How to Use Your Plan

The process is simple.

- Step One: From your plan Overview page, click the links to content in “Next Steps.”

- Step Two: Read the content. Use your MoneySwell tools to complete the step, or, follow through on the content’s action item based on the decision that’s right for you.

- Step Three: Check the item off your list and track your progress in the app.

Here are a few other tips.

- Follow By Tier – Roughly follow your plan by tier. Start with Foundations and check off most or all of those items. Then progress through Security, Growth, Independence, and Abundance.

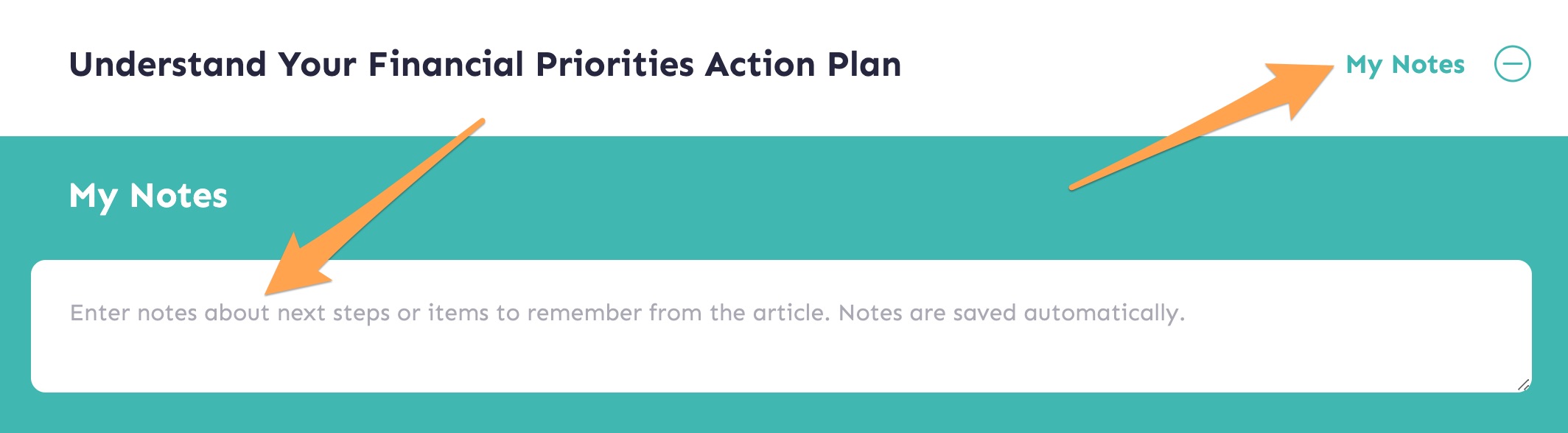

- Use the Notes Field – Above every task is a notes section that can be expanded from the top of the page. Here you can jot down anything that’s pertinent to your situation. Since your tasks are organized by category, you’ll be able to easily find your notes in the future.

- Further Customize Your Plan – Your plan was customized for you when you completed your initial survey. However, by clicking the “View All” links, you can see additional tasks. If you find some tasks aren’t applicable to you, remove them and they won’t be counted against your progress.

Take Action

Look at that! You just completed your first task. If you’re logged in, click the “Mark Complete” button at the top of this page to check it off your list. (If you don’t have a MoneySwell account, start by creating your customized plan with a quick survey.) You’re on your way!

Related Videos