Quick Look

- The first step to successfully learning how to manage your own finances is to tally your life’s basic expenses.

- Whether you follow a regular budget or not, this exercise will help you determine what’s needed to become self-sufficient.

- To achieve financial sufficiency, everyone (rich, poor, and everyone in between!) must balance their expenses with their income.

Self Sufficiency Starts Here

Learning how to manage your own finances and become financially self-sufficient is no easy task. And yet, it’s a task that virtually everyone wants to reach. How do you do it? It all comes down to balancing your expenses with your income.

So, how can understanding the costs of your “basic needs” be helpful? First, it can help you understand the difference between your current expenses, and your possible expenses if you were forced to make some changes.

Secondly, by determining your minimum expenses, you can also determine the income you’ll need to support yourself.

Defining “Financial Sufficiency”

Meeting basic needs is about sufficiency. While you get to decide precisely what “sufficient” means, it shouldn’t be glamorous. It doesn’t include vacations to Mexico, multiple streaming TV services, buying the latest electronics, or a $500 a month clothing budget. Put differently, vacations are extra, you don’t need a streaming TV service, a free cell phone with a basic plan is fine, and most of the clothes you already own are probably good enough.

The categories below are typical “Basic Needs” categories. For each category consider what your costs are (or what they could be). Then, think about all the things that are not on the list. Remember: The goal of this exercise is to define the floor of your expenses. You may decide you want a lifestyle that goes beyond the basics. But by completing this exercise you’ll know the minimum you need to survive.

Basic Financial Needs Categories

- Shelter

- Mortgage or rent

- Utilities (heat, water, electricity, internet)

- Food

- Groceries

- Some eating out or on the go food if essential

- Transportation

- Public transit

- Car (gas, insurance, maintenance)

- Personal Essentials

- Phone plan

- Toiletries

- Medications (if applicable)

- Health Insurance – if you don’t have it yet we’ll cover how to get it in the Security tier. But if you’re going to buy it on your own (as opposed to through an employer), you’ll want to factor this in.

- Professional Essentials

- Anything you need to regularly pay for to be able to continue earning income

- Other Financial Obligations

- Minimum debt payments

Take Action

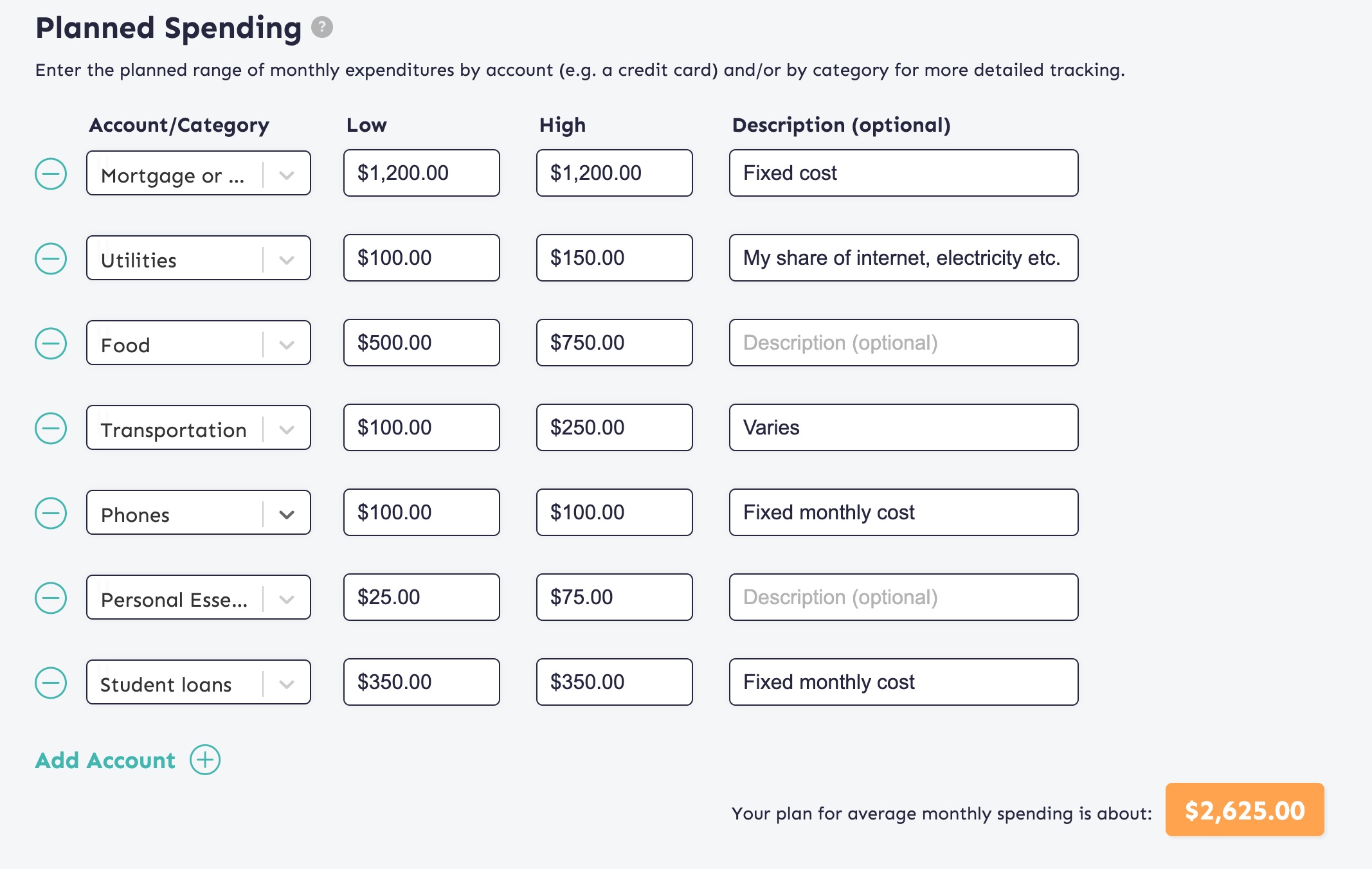

- In the “Plan” tab of Budget Planner, scroll to the “Spending” section and add each category from above. Alternatively simply choose or create the spending categories are right for you.

- Add a value for each category. If your monthly cost is variable, enter a low and high value (MoneySwell will take the average). If it is a fixed cost, enter the same number in both the high and low fields.

- Lastly, record the total of these costs in the notes section above (available for logged in users) for future reference (since you’ll likely be adding additional items in Budget Goals after this).

Note: Even if you end up creating a plan in Budget Planner that tracks by account (a method we really like) instead of by category, there’s a lot of value in going through the exercise of tracking your basic expenses by category at least one time.

Related Videos