Quick Look

- The Budget Planner tool helps you create a plan for all three types of cashflow: net income, saving and spending.

- You only need to update your numbers once a month and can review your progress to see if you’re on track.

- When your goal’s timeframe ends, make a new goal and start again.

Cashflow Means Earning, Saving, & Spending

Whether you want to set a goal for how much you earn, save, or spend, it’s all part of your cashflow. And whether you earn as much as Bill Gates or you currently have a lower paying job, everyone must manage their cashflow to achieve sound financial health.

For each category (income, saving, spending) Budget Planner uses “Net” dollars. That means the after-tax dollars that you actually have available to you.

- Examples:

-

-

- Net Income: You may get a paycheck from your employer or your client for $1,000. But after taxes and other deductions, the amount that gets deposited into your checking account may be $750. $750 is your net income.

- Net Savings: Use this category to track liquid cash savings, or after tax retirement account savings (like in a Roth IRA). For example, if you’re building up an emergency fund, track how much you put into that account each month.

- Spending: Almost all forms of spending are “net spending.” This is because spending generally happens with after-tax dollars. Go to dinner and the movies? Both are “net spending” dollars.

-

How to Use It

Here’s a one-minute overview video of Budget Planner. Budget Planner is broken into three steps, each with their own tab: Plan, Update, and Review.

Plan Tab:

- Watch the Plan Tab video: This video covers much of the detail you need for the Plan tab of Budget Planner.

- Determine the timeframe you want to track your goals for based on the start and end months. (Your plan will always start on the first day of the first month and end on the last day of the last month.)

We recommend setting a plan for as short as three months, or up to one year.

Since cashflow fluctuates, plans less than three months don’t allow for natural variability between months. A plan for more than a year doesn’t allow for likely changes to your income or spending habits.

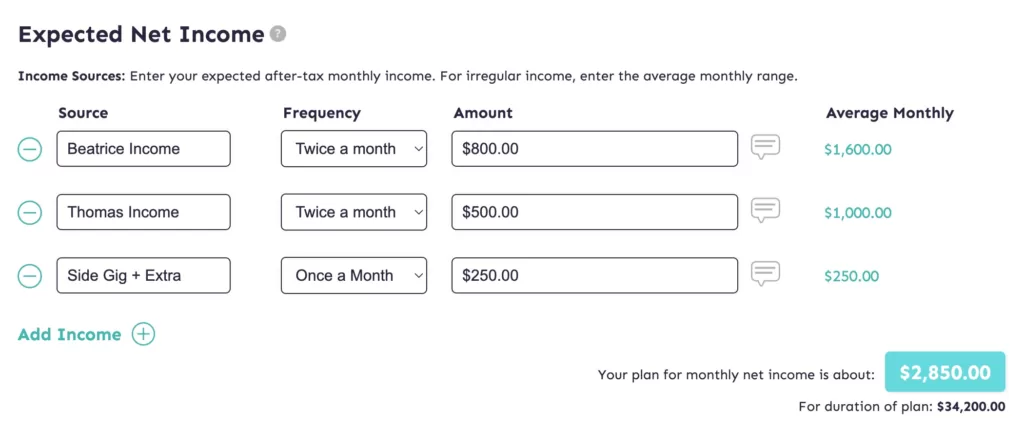

- Enter planned net income: Enter all the sources of income you want to track and how often you receive that income. For the amount, enter a “ballpark” figure. For example, if you get a paycheck twice a month and sometimes it’s a little higher or lower based on taxes taken out or for other reasons, don’t sweat it. Enter the typical amount (or a figure slightly lower if you want to be conservative) and move on. You’re simply trying to set a goal based on the rough amount of income you expect.

Note: If you have irregular income, estimate your average low and high values. MoneySwell will average the low and high numbers. For example if you have a side gig typically earning between $300 and $600 a month, your average would be $450 (($300 + $600)/2 = $ 450 monthly).

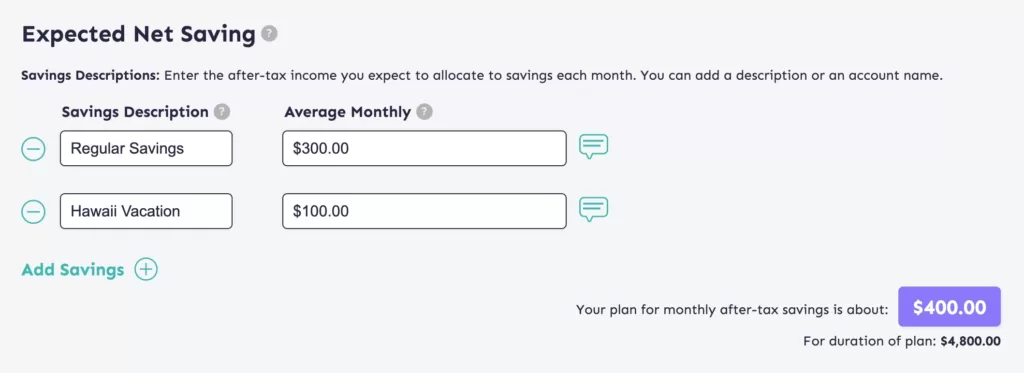

- Enter planned net savings: Enter low and high estimates for the amount you plan to save each month. MoneySwell will average the low and high numbers.

(Remember this is after tax savings. Budget Planner is not meant for tracking savings to 401ks or other savings strategies where money is taken out of your gross earnings.) If you consistently save a specific amount, like an automatic monthly transfer, enter the same number in the “Low” and “High” boxes.

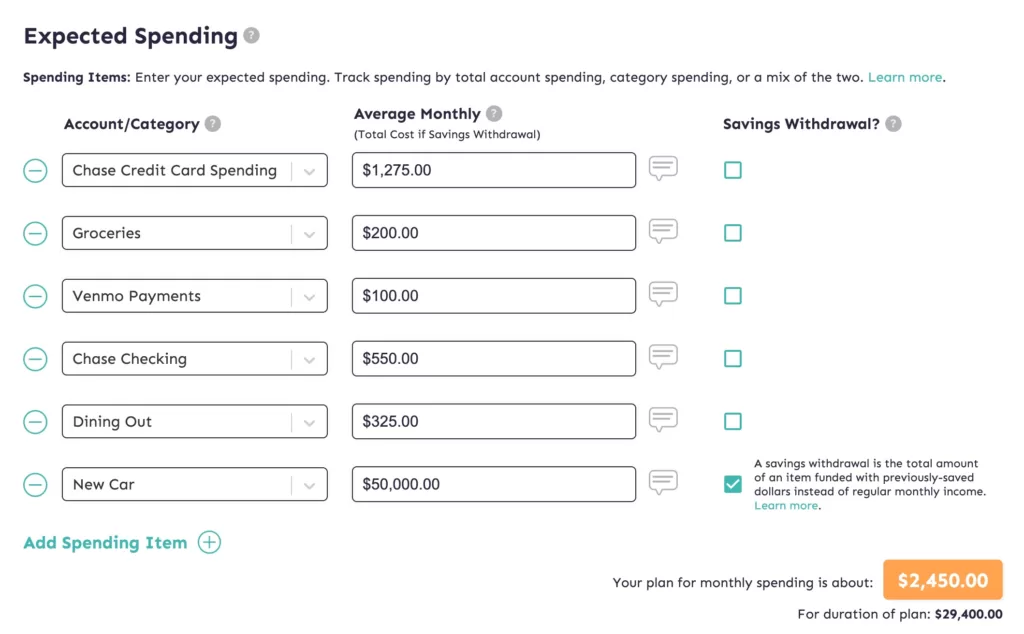

- Enter planned spending: Enter estimates for anticipated spending. You can make this as detailed or as simple as you like. A detailed way would be to track spending broken down by spending category. A simple way would be just to track the total spending by account.

This is an example of tracking by account, and a few categories (e.g. dining out, groceries, and a new car purchase).

We highly recommend tracking by account and not by category or a mix of the two (but not just by category). This will limit the number of things you have to track, while still giving you a highly accurate picture of your total spending.

To track by account, look at the “Total Purchases” line on your account statements. A few month’s worth of statements will give you a good estimate of your typical spending. If you want, you can average the numbers between statements and enter that number in both fields.

You can also take a “mixed approach” and track some things by category (for example rent or mortgage payments), and some things by account. If you do this, just make sure you don’t double counting spending that is within both a category and an account.

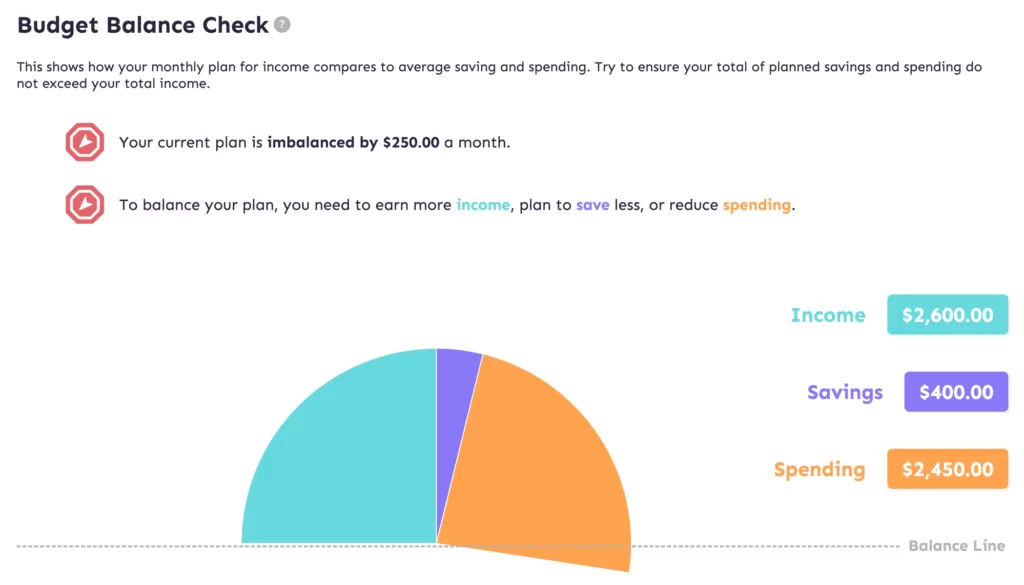

- Review your “Plan Balance Check”: This shows you if your plan is balanced. Specifically, it shows how your planned saving and spending compare to your planned income. If planned saving and spending are greater than income, your graph will extend beyond the “balance line.” It will also tell you how much your plan is imbalanced by so you can adjust it if desired.

This user’s plan is imbalanced. But by increasing income, reducing planned saving or spending it could be balanced.

Note: You do not need to have a balanced plan. Perhaps you’re a student and have very little or no income. Or perhaps you are simply comfortable drawing down your savings while you take a break from regular work. In either case, your spending would be more than your income. But you can still use this tool to set budget planning and cashflow goals.

Update Tab

- Watch the Update Tab video: This video covers much of the detail you need for the Update tab of Budget Planner.

This is where you update your actual income, saving, and spending. You’ll compare your actual values to your planned values. Simply enter the actual values for the month, and click save.

A Few Notes

- Since all plans are based on monthly averages for income, saving, and spending, you only need to update your numbers once a month. However if it’s easier, you can update your numbers as they change. This might be easier if you track spending by category (as opposed to by account). For example if you track “Food” as a category, and you spend $10 on a lunch one day, you could update your number for “Food” by adding $10 to the previous total. (And again, if you find this too cumbersome, we recommend tracking spending by account…see above.)

- Don’t worry if your numbers are a little (or even a lot) off for a given month. As long as you understand why the number may be different that month (e.g. your side gig income was less because you were traveling half the month or your spending was higher because you bought an appliance etc.). The only thing that really matters is if you can get on track by the end of your goal’s timeframe.

Review Tab

- Watch the Review Tab video: This video covers much of the detail you need for the Review tab of Budget Planner.

After you’ve updated your numbers for the month, review your pacing and breakdown for income, saving, and spending since the start of your plan.

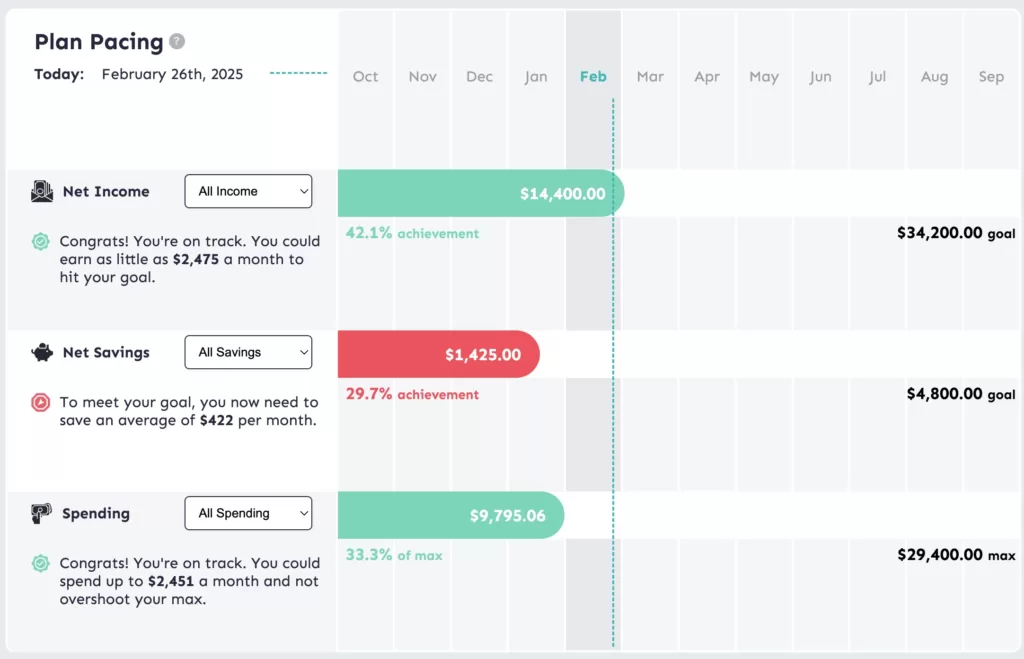

- Plan Pacing: This will show you if you’re on or off track. It can be broken down by income source, savings account, or spending category respectively.

It will also tell you how much you need to earn, save, or spend to hit your goal by the end of your timeframe. Your pacing bar moves daily. For income and savings, it will show you as “On Track” if your totals are in front of the pacing bar or at least within the current month. For spending, it will show you as “On Track” if your totals are behind the pacing bar or within the current month.

If you’re way off track and have no chance of achieving a goal, go back to the “Plan” tab and update your goal! Budget Planner is not about perfection. It’s about progress! And progress is all about being flexible. It’s your job to find the balance of challenging but achievable goals. So, when it feels right to you, make the adjustments as needed.

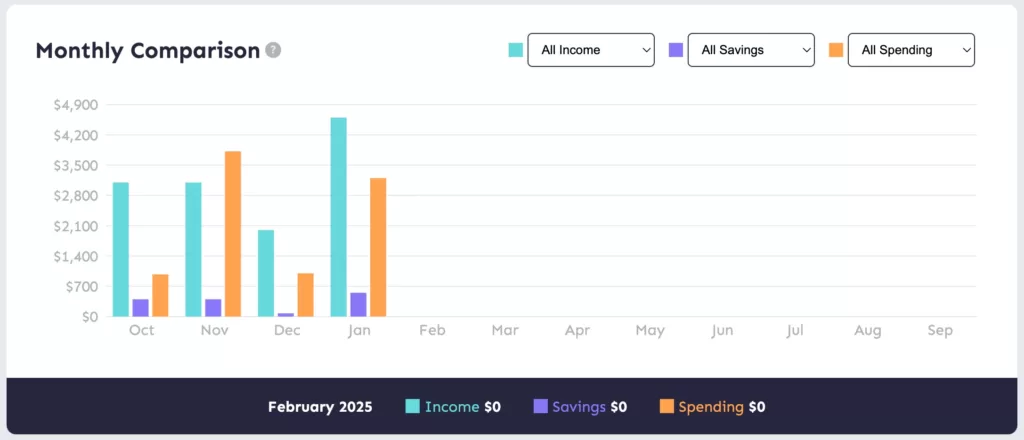

- Monthly Comparison: This shows you how your income, saving, and spending compare month over month. You can break it down by “All Income/Saving/Spending” or by any of the specific categories you set up.

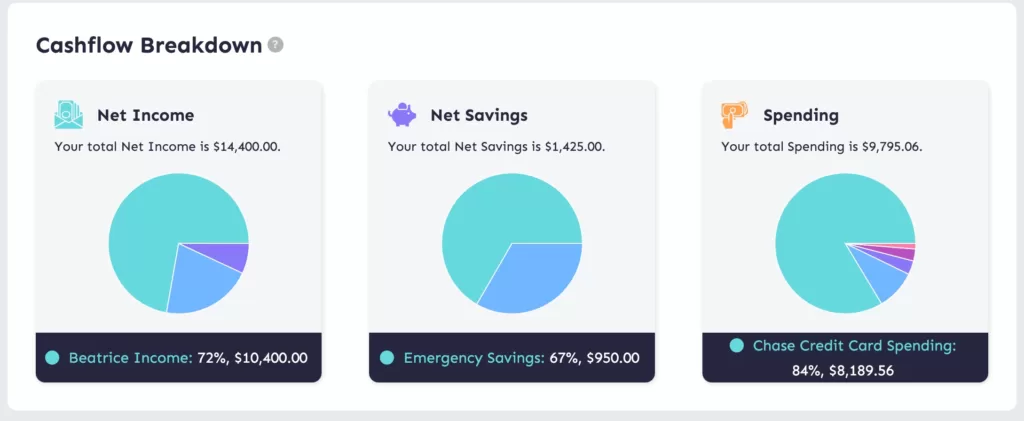

- Cashflow Breakdown: This will show you your total income, saving, and spending and a breakdown of the associated sources, accounts, or categories.

Related Videos