Quick Look

- Use your Assets & Liabilities tool to track all your bank account values in one place.

- “Linked” accounts can be synced with your institution with a single click.

- “Manual” accounts allow you to track assets and liabilities not at a traditional institution (like the value of real estate or debts owed to family).

- Your goal is to build a record of your financial progress over time.

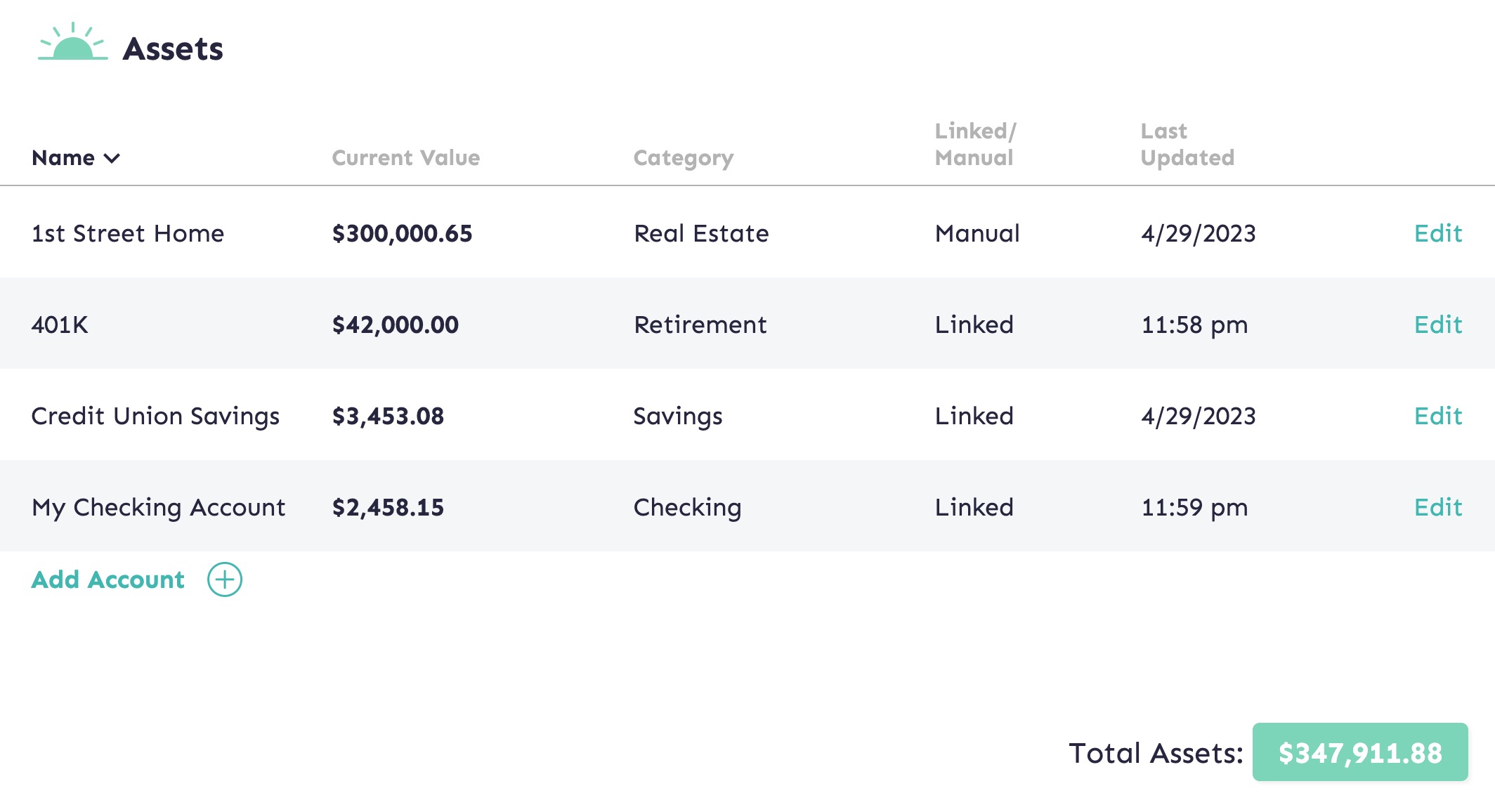

Assets

This will include anything of value that adds to your net worth. Examples include:

- Checking and savings accounts

- Retirement accounts (401ks, IRAs, TSPs etc.)

- Other investment accounts

- Real Estate (home, rental property etc.)

- Other items (vehicles, valuables, family heirlooms etc.)

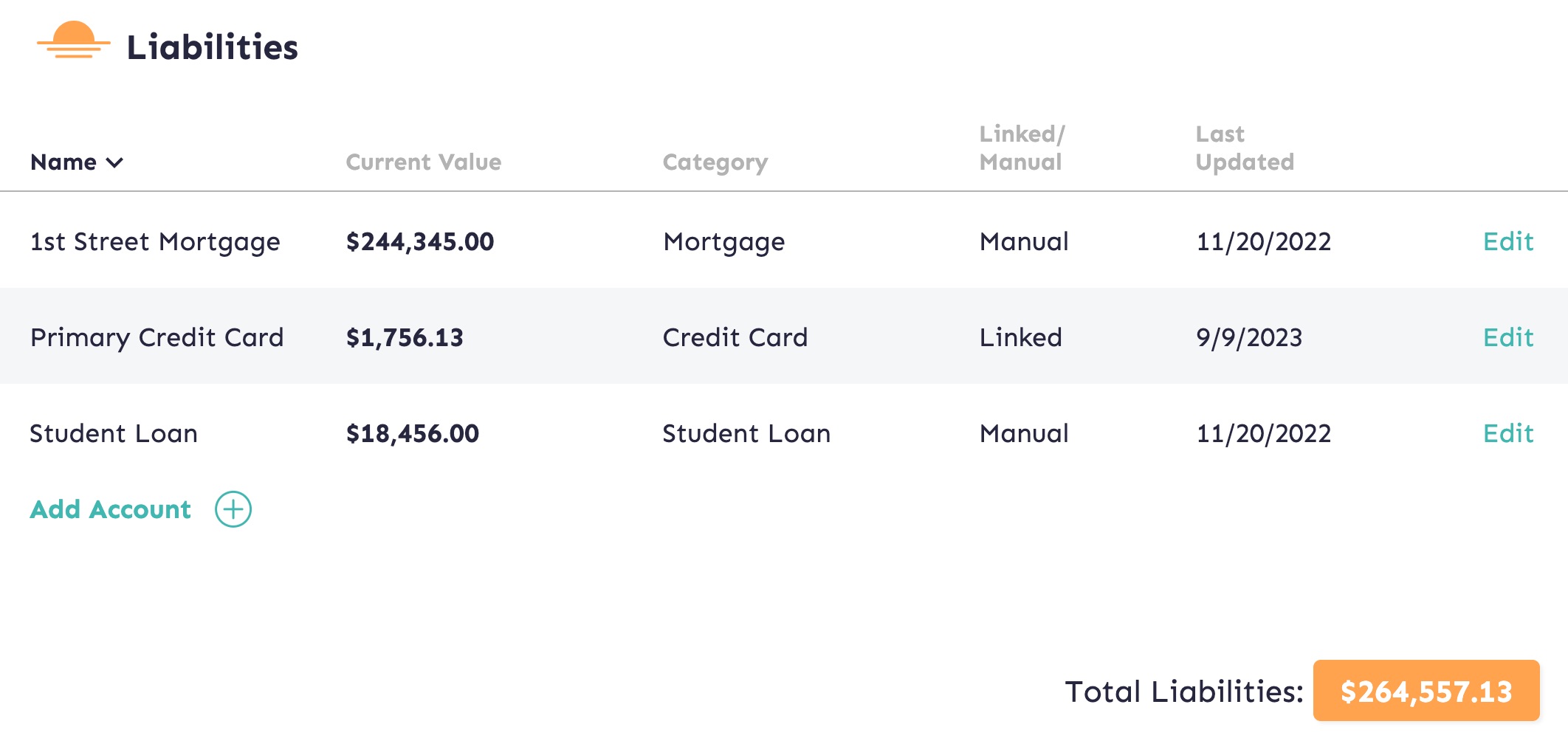

Liabilities

This will include anything you owe that subtracts from your net worth. Examples include:

- Bank Loans (student loans, mortgages, personal loans etc.)

- Credit Card debt

- Medical Debt

- Family/friend Loans (money loaned by family or friends)

How to Use It

Tracking your information is simple.

- On the “Accounts Tab”, add all the assets and liabilities you would like to track by clicking the “+” icon.

- Choose if you would like to link to your institution or add the account manually.

- Once all accounts are added, click to sync your linked accounts to get your most up-to-date numbers. For manual accounts, simply input the values.

- Click the Save to Historical Record button.

Sync your accounts as needed. But in the long run, a history synced only monthly is likely to be more than fine.

When to Use It

You can sync your accounts and save the data to your historical record as often or as little as you like. We recommend saving your data between once a week and once a month. The goal is to build your historical record over time. For most people, a breakdown more detailed than weekly simply isn’t necessary.

- Remember: With MoneySwell, your historical record will automatically save information from the Accounts tab once daily. However, you still control updates to the Accounts tab (based on when you sync your linked accounts or when you update your manual accounts). In this sense only you control what goes into your historical record. We suggest doing a regular update to your accounts near the end of the month. If you forget, you can always update your historical record by clicking the link below the graph on the Historical tab.

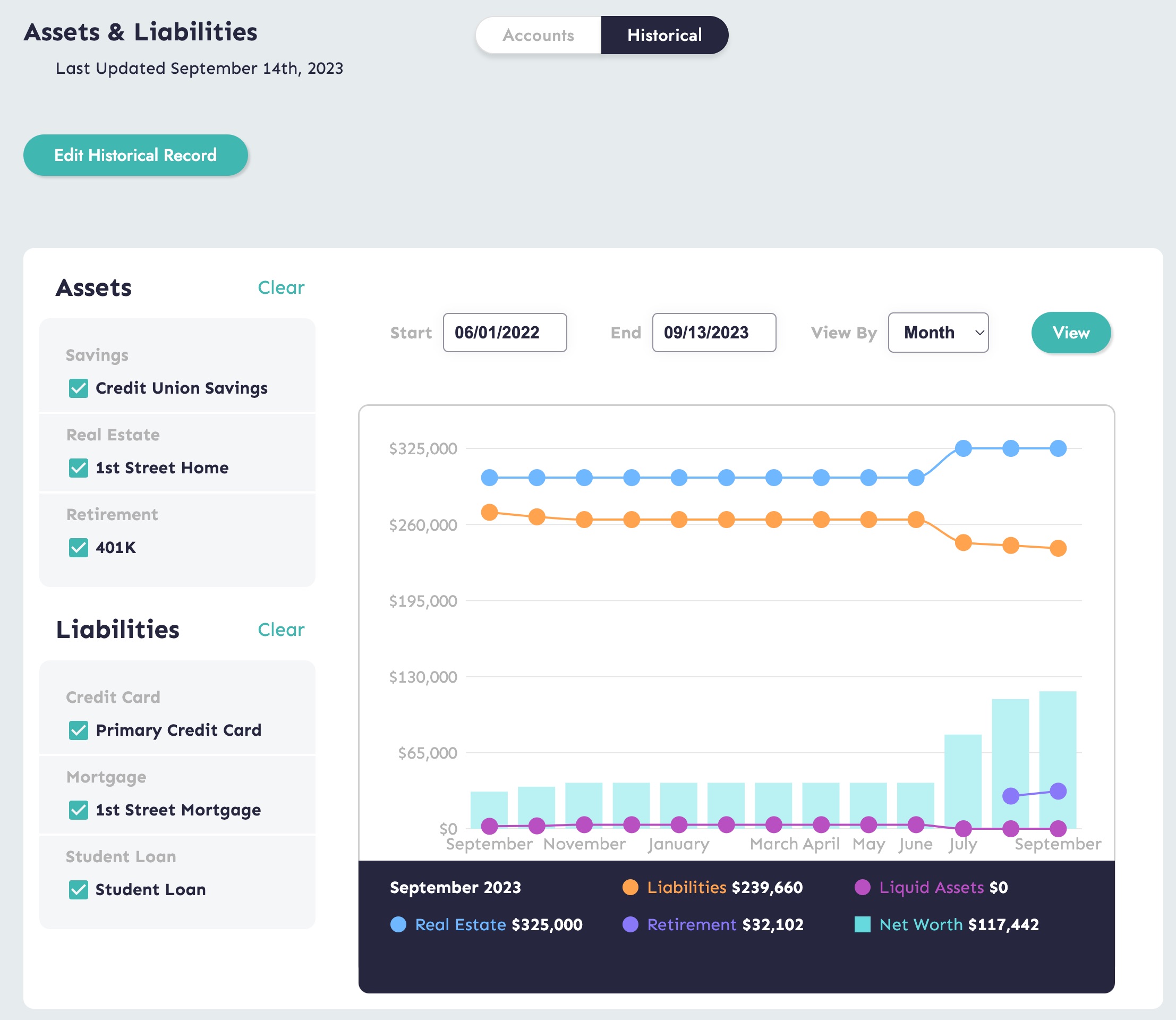

The Historical Tab

While the “Accounts Tab” is where you enter your information, the “Historical Tab” is where you can see your data building over time. Your account data is is broken into assets and liabilities and shown over the time period you select. Your net worth is calculated for you.

Hovering over data points allows you to see your values by category at a given time. Changing the assets and liabilities selected on the left allow you to see only the data you wish to see.

- Remember: Your “Net Worth” is the value of all your assets, minus all your liabilities. So if you had $1,000 of total assets, and $250 of total liabilities, your net worth would be $1,000 – $250 = $750.

You can choose the dates, breakdown visibility (e.g. daily, monthly etc.), and which of your assets or liabilities you would like to be represented in the graph by selecting or deselecting accounts on the left-hand side. If you ever discover that you incorrectly saved data for a given account, you can choose to edit your historical record by clicking the link at the bottom of the graph.