Quick Look

- Fund your emergency fund account to the point where it can cover one to three full months of expenses.

- To determine your amount for one (or three) full months of expenses, use the “Plan” or “Review” tab in Budget Planner.

Contents

Two Emergency Fund Calculation Methods with MoneySwell

If you’ve set up Budget Planner, there are two ways you can use this tool to determine how large your one to three month emergency fund needs to be.

Method #1 – Using the Plan Tab

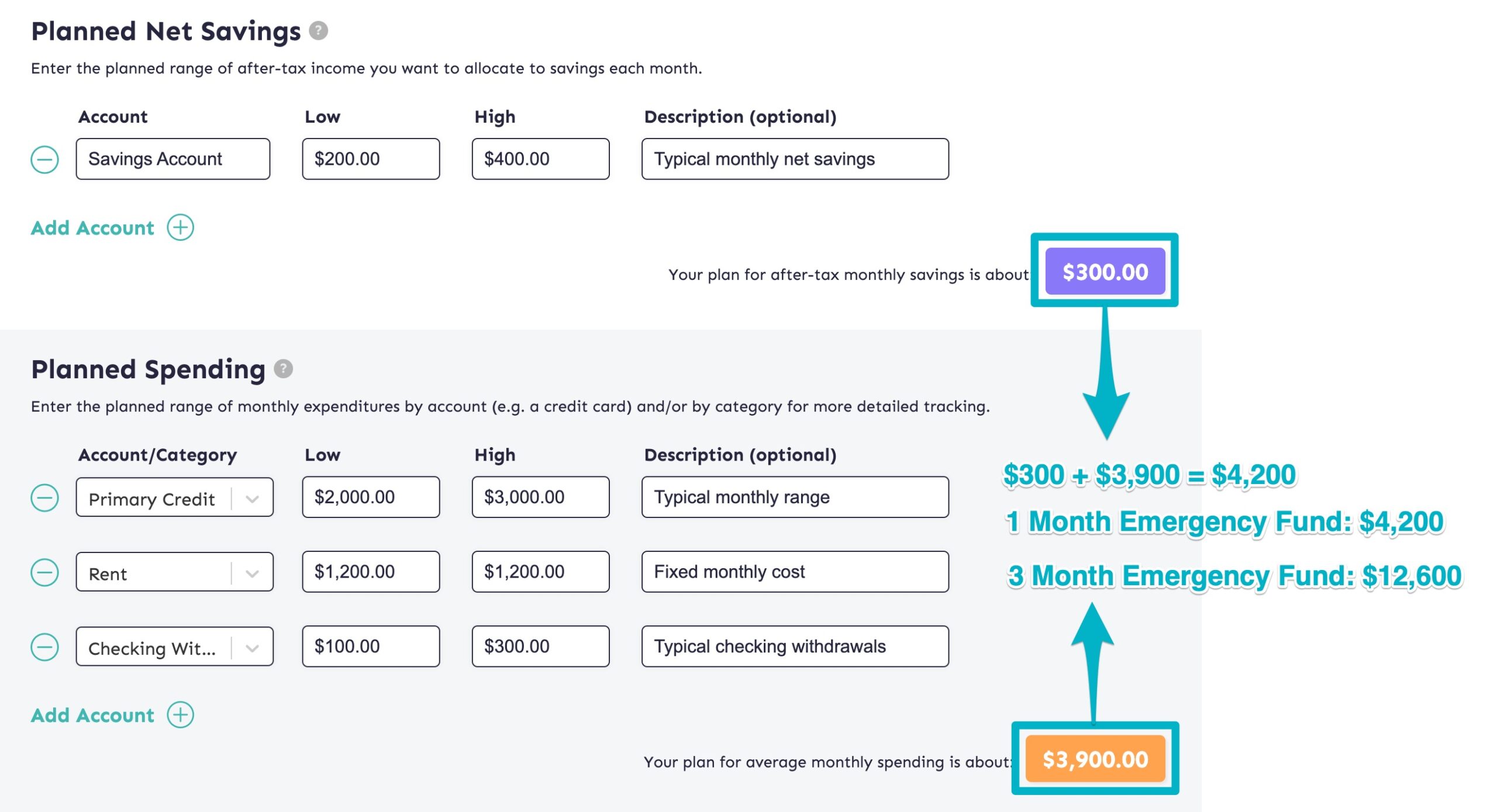

In the Plan tab you can see your plan for average monthly saving, and expenses. Follow these steps:

- Add your savings and expenses together.

- If you’re saving for multiple months, multiply that by the number of months you’re saving for.

You now have one (or three) months worth of planned savings and expenses. This is your Emergency Fund Security goal.

Method #2 – Using the Review Tab

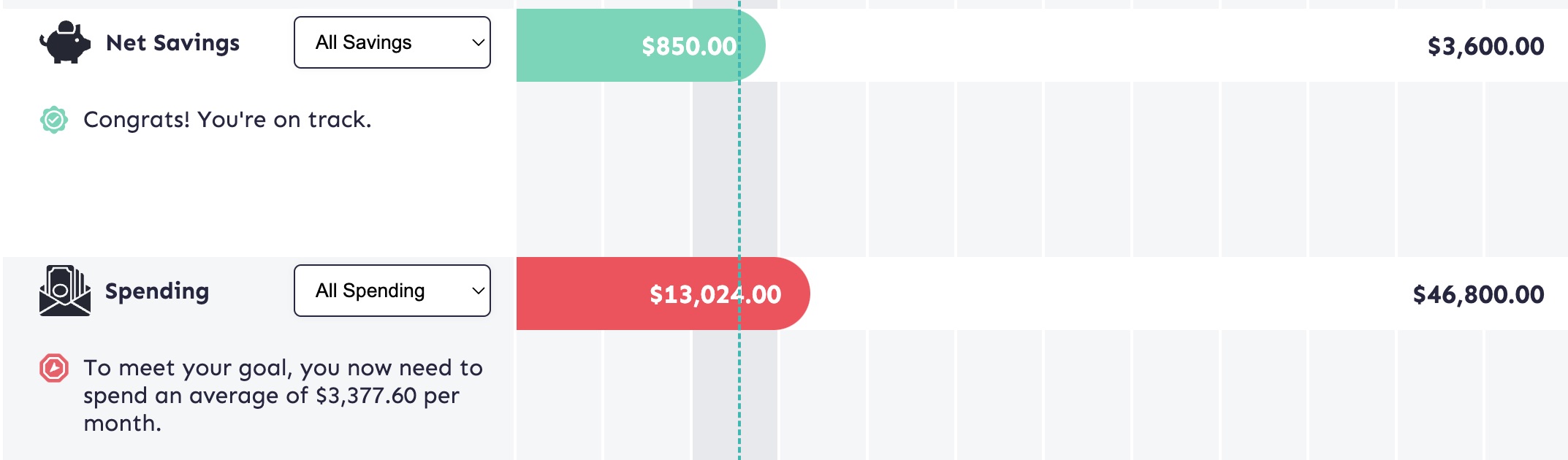

This user PLANNED to spend $3,900 per month ($46,800 / 12 = $3,900). However, over three months they’ve ACTUALLY spent an average of $4,341 ($13,024 / 3 = $4,341). To be safe, they should probably use the larger number as the basis for calculating their emergency fund.

After entering however many full months (partial months entries will distort your numbers) of actual saving and spending data you want in the Update tab, go to the Review tab and follow these steps:

- Add your total saving and total spending from the graph.

- Divide that number by however many full months of data you have. This will give you your actual average monthly savings and expenses.

- Multiple that number by three (or whatever number of months you’re hoping to save for).

You now have one (to three) months worth of actual saving and expenses. This is your emergency fund Security goal.

Why include the “savings” number?

It can seem counterintuitive to include a “savings” number in your calculation for your emergency fund goal. But there are great reasons to do this. Here are two.

Reason One: An emergency fund can act as a job loss fund. Put differently, “If I lost my job tomorrow, how long could I survive before I needed to start earning income again?” But for many Americans, a job can also cover the cost of things like health insurance, a cell phone bill, a gym or transportation subsidy etc.

Whatever the case case, by including your monthly savings in your calculation, you have given yourself an extra cushion for additional expenses you may not have initially been thinking about.

Including your savings number in your emergency fund calculation gives you an extra buffer to stay on track if you have to dip into your emergency fund.

Reason Two: The goal of an emergency fund is to keep you on track when something unexpected happens. “On track” can mean not having to go into credit card debt, not having to sell off a portion of your retirement savings in order to make ends meet, or, it can mean keeping on track with your savings.

Savings could be for long-term goals like retirement, or medium-term goals like vacations or a new car. (And of course, you may be saving for your emergency fund itself. In this last case, obviously you won’t keep putting money into your emergency fund at the same time you’re drawing it down should an emergency come to pass.) By including a savings number in your calculation at the outset, you’re working to build a larger emergency fund and one that is more likely to sustain you should something go awry.

Conclusion

Fully funding an emergency fund for one to three months of expenses is a fantastic start! Unfortunately, more than half of Americans don’t have emergency savings for a $400 expense, let alone a full month or more of expenses. If you’ve met your Emergency Fund Security goal, great job! You can now check this off your list.