Quick Look

- From your regular day-to-day checking account, set up an automatic, recurring transfer to your dedicated emergency fund account.

- Look for the “Transfer” link (or similar), confirm your emergency fund account is a linked account, set the amount, and set the frequency.

- If you’re not sure how much you’ll be able to afford each month, simply set up a small monthly transfer you can afford – even if it’s only $5.

- If you get paid regularly, consider setting up automatic transfers scheduled for a day or two after each payday.

Contents

Set Up an Automatic Transfer, Even if You Start Small

Setting up automatic funding for your emergency account is one of the surest and simplest ways to make sure it grows. When experts say, “Pay yourself first”, they’re suggesting that every time you get paid you put aside a bit of that money that your future self can use – whether it’s for your retirement, a rainy day, or otherwise.

Even if you can only afford to make a very small automatic transfer, setting it up now will make it that much easier to update in the future to a larger amount. And seeing your emergency fund grow, even if it’s only by a few dollars a month, will be a reminder that progress is possible.

Determining Your Transfer Amount

Use your MoneySwell Cashflow Goals tool to help find a number that will be good for you.

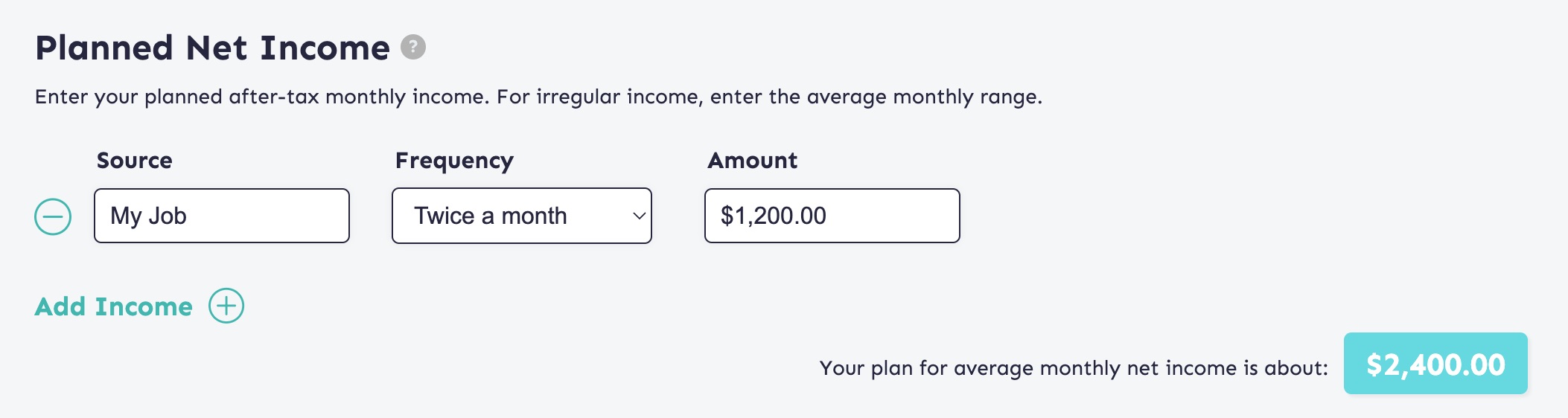

- On the “Plan” tab, enter your typical net income (the money you actually get in a paycheck after taxes are taken out) – see Pro Tips below.

- Skip “Planned Net Savings”…for the moment

- Enter your typical expenses – see Pro Tips below.

- Now look at the graph at the bottom of the page.

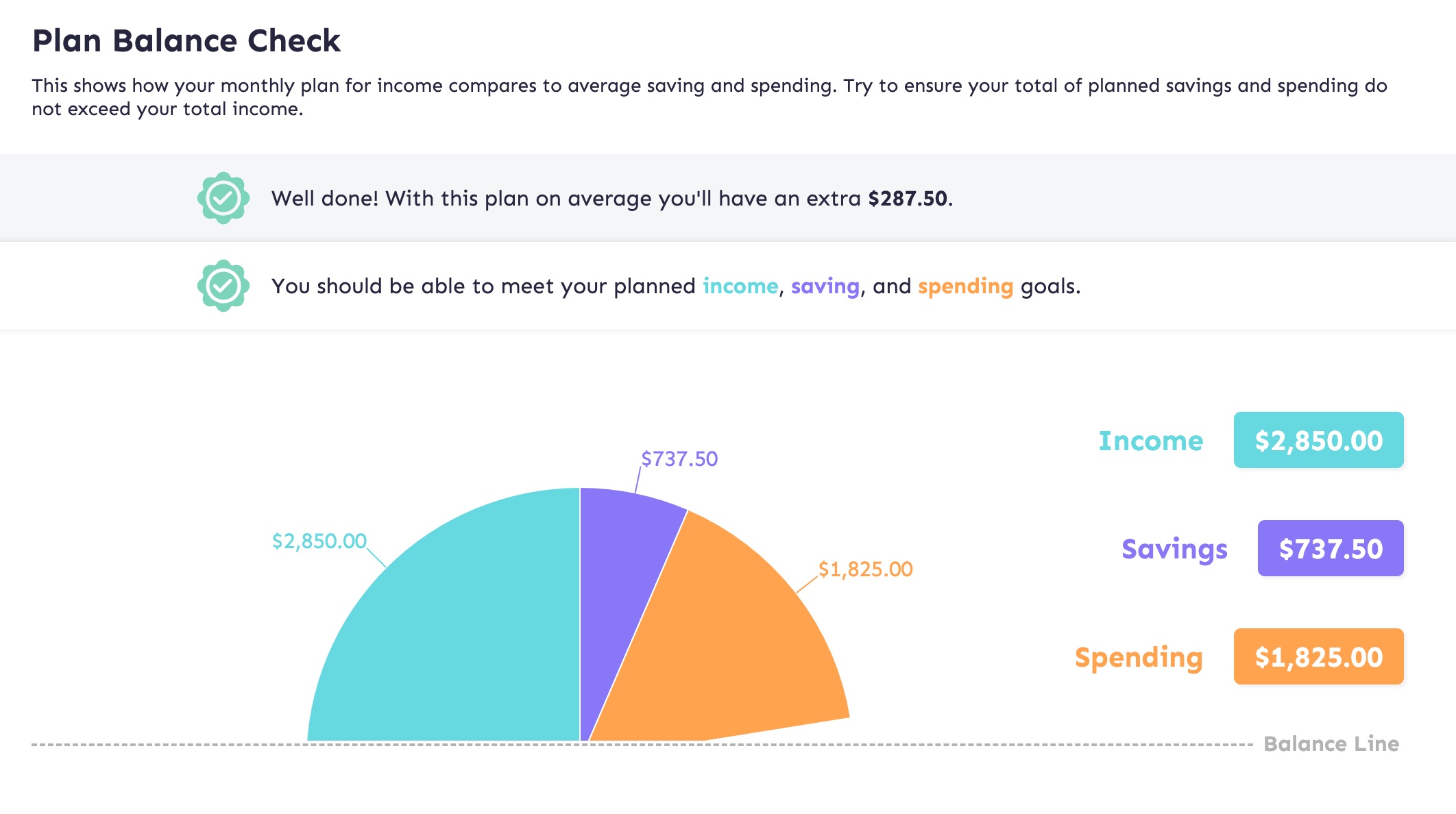

If it says “Well done! With this plan on average you’ll have an extra $____.”, then that number represents the maximum you would likely be able to transfer each month. However, since this will be an automatic transfer and you want to ensure you avoid overdraft fees etc., you should probably only set your transfer for some percentage of that value – anywhere from 50-90% depending on the consistency of your income and spending habits.

If it says “Your current plan is imbalanced by $____ a month.”, this means you’ll need to find a way to earn more or spend less of your net income in order to consistently put money toward your emergency fund. See if you can make some changes to get your plan in balance. - Once you’ve determined your automatic savings, add that in in the “Savings” section. If you have a stretch goal beyond your automatic savings, enter your automatic savings in the “Low” field and your monthly stretch goal in the “High” field.

Pro Tips for Estimating Income & Expenses

Estimating Income

- If you get paid regularly, the simplest way to estimate your income is to look at your paychecks and see how much your net paycheck is. Then, determine how many times you get paid each month and multiply your net paycheck times that number.

- If you get paid irregularly or your income varies, look at the last several months of bank statements and average the total deposits you make each month.

- If you’re often paid in cash or largely in tips, you’ll need to track this manually. But you may want to consider making regular deposits to your bank account so you have a clearer picture of your net income via bank statements.

Estimating Expenses

Follow this process for a simple way to estimate expenses.

This user is primarily tracking her spending by account but she has decided to make rent its own line item.

- Make a row for each credit and debit card you have.

- Then for each card, look at a few months of statements, and either…

- Average the “Purchases” or “Withdrawals” from all the statements and enter the same number in the “High and “Low” fields, or…

- Just enter the lowest statement month in the “Low” field and the highest statement month in the “High” field and MoneySwell will average those two numbers.

- If you have any regular expenses not accounted for in your credit or debit card statements add a row for each of these.