Quick Look

- Broadly speaking, there are three ways to save for retirement outside of a single retirement account.

- Invest more money

- Diversify your investment accounts

- Create new income streams

- To diversify your investment accounts, consider a secondary retirement account that uses either pre or post tax dollars – whichever one is different from your primary retirement account. This can help you save on taxes as you draw income from your nest egg in retirement.

Contents

Beyond the Nest Egg Number

Now that you have an idea of what your retirement nest egg might need to be, the next question is, “What do I need to do to get to that number?” If you already use the MoneySwell Retirement Planner, you can clearly see how given savings rates may affect your future outlook. And by using the Experimentation Box (Step 3 of the Retirement Planner) you can see how reduced spending or alternate income streams can affect your nest egg needs.

Whatever the case, there’s a good chance you will want to invest more and create additional income streams beyond a single retirement savings plan. Here are three options to consider.

Invest More Money

Typically, different retirement accounts funded with the same “type” of dollars (i.e. “pre tax” or “post tax”) have a total combined limit for contributions. For example, if you have a 401(k) and a Traditional IRA both funded with pre-tax dollars, the total combined limit in 2022 is $20,500. So if you contribute $10,000 to one account, you can only contribute up to $10,500 in the other. However, if you want to invest more and are eligible to fund an account with post-tax dollars – like a Roth IRA – you can contribute up to the maximum for that account in addition to whatever you put into a 401(k) or Traditional IRA. Using this example, since the Roth IRA contribution limit is $6,000 in 2022, a person with both a Roth and a Traditional IRA and/or a 401k, could contribute up to a total of $26,500.

Different account types are funded with different types of dollars (pre/post tax) and allow you to diversify your income in retirement.

Another way you can contribute more – even if it’s with the same “dollar type” you have used to fund other accounts – is to generate income through self employment and open an individual 401(k) or SEP IRA associated with this self employment income. These accounts have higher maximum contribution limits (e.g. a SEP allows the lesser of $61,000 or 25% of your income in 2022) and are not affected by contributions to a separate employer-based 401(k).

Finally, if you aren’t eligible for these options, you can always open a standard brokerage account. While you’ll miss out on the tax advantages of certain types of retirement accounts, you also won’t be subject to some of their limitations including contribution limits, withdrawal rules, and more. Not only can this provide for flexibility for income in retirement, it can also provide options for income before retirement.

Diversifying Accounts

When we say “diversifying accounts,” what we really mean is diversifying the type of dollars (pre tax vs. post tax) that you use to fund your retirement savings. For example, a 401k is funded with pre tax dollars whereas a Roth IRA or a Roth 401k is funded with post tax dollars. What’s the advantage of having both types of dollars funding your retirement accounts? Put simply, it gives you the ability to stretch your dollars further in retirement. The reason is that income in retirement that comes from an account funded with post-tax dollars, won’t be looked at by the IRS as taxable income.

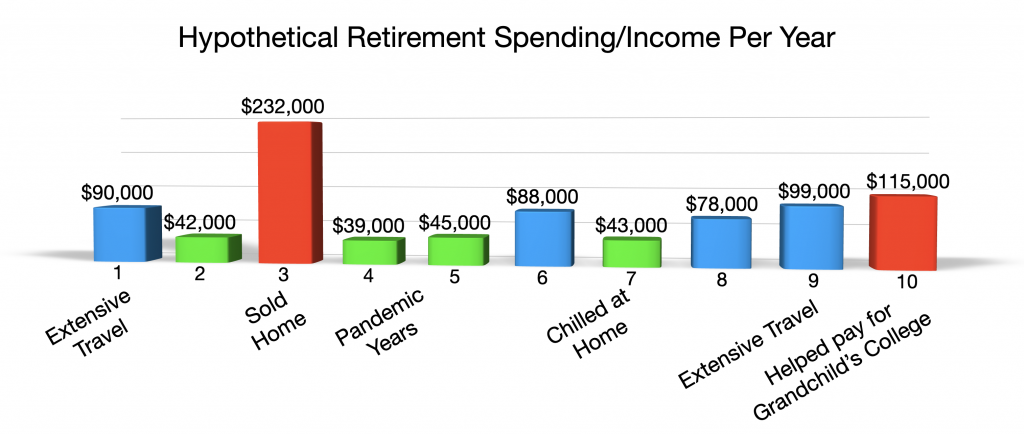

As a general rule, the more income you show in a given year, the higher your tax bracket and the more taxes you pay. But consider this: Spending and income in retirement isn’t static. It fluctuates. For example, the graphic below shows hypothetical spending during the first ten years of retirement. The red columns represent high income/spending years, blue columns represent medium spending years, and green columns represent low spending years.

Broadly speaking, in years where spending is low, you’d want to sell taxable invested assets (i.e. assets originally purchased with pre-tax dollars) since that year you will be in a lower tax bracket. Conversely, in years you know income and spending will be high, you might want to have at least some of that income come from the sale of tax-free assets (i.e. assets originally purchased with post-tax dollars). This is example of a tax diversification strategy.

Making these easy year to year adjustments in retirement could significantly reduce the total amount of tax you pay. But it’s only possible if you have both types of assets to draw from in the first place. That means you’ll want to diversify your retirement accounts and fund them appropriately.

Additional Income Streams

Do you have a business idea that can scale or generate mostly passive income?

Remember that whatever reliable, mostly-passive income you can generate in your retirement years reduces the total amount of income you need to generate by drawing down your nest egg assets. Common examples of “reliable” and “mostly-passive” income would be Social Security, a pension, or rental property income. But ultimately, other streams of passive income are only limited by your creativity and ability to create value through a product or service that can grow without requiring a comparable growth of your time and effort (this is called “scaling”). Based on this, consider the content in the passive income article previously discussed.

Even a small amount of reliable, passive income can have a significant effect on how large your nest egg needs to be.

Action

If a tax diversification strategy in retirement is important to you, use the notes section above to write down the accounts available to you and the amount you can fund that account with each month. Then open the account and begin funding it. Even a little bit every month can be significant down the line. Additionally, jot down a few notes on the possible sources of passive income you may have in retirement.